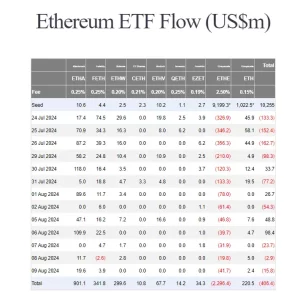

BlackRock’s iShares Ethereum Trust (ETHA) is set to go down in history as the first-ever US spot ETH ETF with a billion dollars worth of net inflows within three weeks of launch. At present, ETHA has gathered around $901 million and is expected to break the $1 billion barrier this week, commented Nate Geraci, the president of The ETF Store. ETHA has ramped up quickly and is now among the top six ETF launches of this year.

While BlackRock ETHA’s assets grew steadily over the past month, attaining $100 million, the growth has been steady but slow compared to IBIT’s boom past the billion-dollar mark after merely four days. ETHA is the fastest-growing spot in Ethereum ETF. However, it still remains behind Grayscale’s Ethereum ETF (ETHE), which has $4.9 billion in AUM despite a net outflow of $2.3 billion.

The meteoric rise of ETHA also comes as another triumph for BlackRock after IBIT replaced Grayscale’s Bitcoin ETF (GBTC) as the largest spot Bitcoin fund, with around 348,000 BTC held worth $21 billion in total. While ETHA could end up being a major player in the Ethereum ETF market, it is not yet clear how that will come to pass, given its competition with Grayscale.

With ETHA charging ahead, it could overtake ETHE in AUM as ETHA capitalizes on increasing demand for an Ethereum digital asset. But competition remains fierce, particularly from Grayscale Ethereum Mini Trust, which, despite more modest inflows, still has $935M in AUM.

Last month, Adam Morgan McCarthy, an analyst at Kaiko Research, mentioned DL News: “The value proposition for a crypto-native fund holding ETHE is hard to see when these funds can redeem shares and buy Ether to stake in return for yields — as opposed to paying high fees to stick around in Grayscale’s fund” seems to be slowly rolling into action.

While it has already been an issue mainly raised by crypto-native investors, as more people who are used to directly holding and staking Ether get wise to such things — like earning staking rewards themselves versus through a custodian — they could probably start asking even more challenging questions about the fund’s steep expenses.

As investors potentially repeat this process, there could be an emerging trend where ETF holders redeem their shares for physical purchases of Ether instead — skipping the management fees altogether in favor of direct exposure and potential yields. If this trend picks up steam, it could undercut the actual value of traditional fee-laden ETFs like ETHE and ultimately threaten Grayscale’s supremacy in a crowded market.

To remain the market leader, Grayscale might need to implement some strategies—lower fees, staking rewards, or more liquidity—to attract and retain investors. With the market now on the edge of its seat, investors are keen to see how Grayscale’s Ethereum ETF will make its next move.