Apr 21, 2025— The crypto market witnessed a sudden surge in buying pressure following Bitcoin’s recovery to $88,000. The recovery is likely linked to the weakening of the U.S. dollar and the stock market correction, leading investors to alternative investments. While most major altcoins accompany the bullish momentum, the Ethereum price underperforms, signaling a risk of another decline.

Interestingly, the crypto whale seems unbothered and continues to accumulate ETH, while the network also records notable adoption. Is a reversal close by?

Whale Accumulation and ETH’s Growing Adoption Amid Market Uncertainty

Over the past two weeks, the Ethereum price has been trading in a sideways trend around the $1,600 level. The consolidation with a short-bodied candle and rejection on either side accentuates uncertainty and no initiation from buyers or sellers.

Despite the lateral trend, the crypto whale continues to show their confidence in ETH as they accumulate more in the current dip.

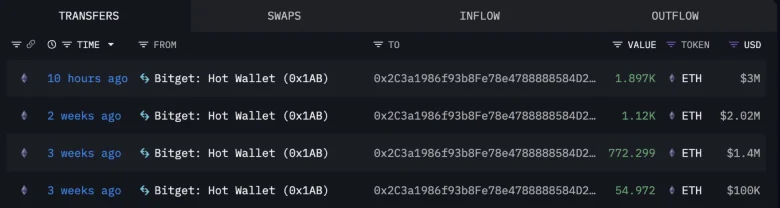

According to recent data from Lookonchain, a crypto whale withdrew 1,897 ETH (worth approximately $3 million) from the Bitget exchange some 10 hours before reporting. This withdrawal is part of a larger trend, as the same whale has pulled a total of 3,844 ETH (valued at $6.51 million) since April 3.

Such whale activity has often acted as a precursor to a potential price surge, as these largest holders continue to amass Ethereum, significantly boosting market sentiment and increasing scarcity.

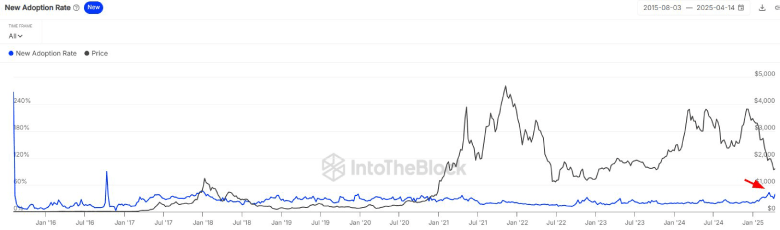

On another front, IntoTheBlock reports that Ethereum’s adoption rate reached a significant milestone, nearing 40% in the past week. This surge in adoption is seen as a clear sign of robust user growth, which appears to be driven by increased interest from first-time users.

Such a spike in adoption when the market conditions are uncertain suggests strong fundamentals for Ethereum, as more users, rather than mere investors, seem to be integrating into its ecosystem.

Ethereum Price Faces 11% Amid Overhead Supply Pressure

By press time, the Ethereum price trades at $1573, with an intraday loss of 0.88%. Despite the broader market upswing, Ethereum’s daily chart shows a long-width rejection candle, indicating overhead selling.

With the sustained bearish momentum, the coin price could plunge another 11.6% to test the multi-year support of $1,385.

If the support holds, the ETH price is likely to rebound back to the $1,800 level and challenge the resistance trendline of a falling channel pattern. This chart pattern has been carrying the current correction trend within two converging trendlines, which provide dynamic resistance and support to the price.

A bullish breakout from this pattern will be crucial for buyers to change the market direction.

Also Read: Bitcoin Price Hits $88,000 in Sudden Surge— Here’s What’s Driving It