DOGE, the dog-themed meme cryptocurrency, bounced 4.9% during Thursday’s U.S. market session to trade at $0.24. The buying pressure followed a broader market surge as Bitcoin made a new high of $112,000 and panic selling surrounding the U.S.-imposed tariff subsided. Will Dogecoin price build on this momentum to breach the $0.3 barrier?

DOGE Price Gains Momentum As Futures Open Interest Jumps 134%

Dogecoin’s daily chart analysis shows a sustained recovery from $0.129 to $0.248, registering a 91.9% gain in the last seven weeks. The bullish upswing can be linked to a renewed recovery trend in Bitcoin’s price and the subsided panic selling surrounding the U.S.-imposed tariffs.

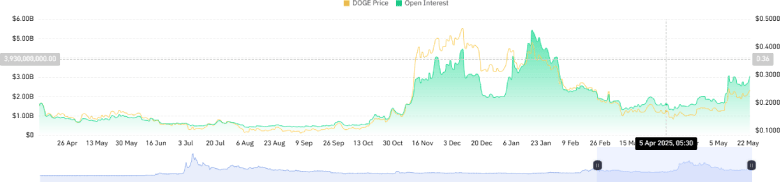

Following the price rally, the DOGE futures open interest also bounced from $1.31 billion to $3.07 billion, registering a 134% surge.

This suggests that Dogecoin’s derivatives market has seen a significant inflow of fresh funds, indicating heightened speculative interest and greater trader engagement. A sharp spike in open interest frequently precedes increased volatility as traders place larger directional bets.

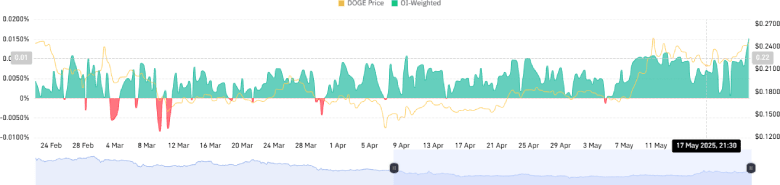

The OI-weighted funding rate has also increased to 0.0159%, the highest level since January 2025, as the Dogecoin price continues to rise. This suggests that holders of long positions pay more to keep their positions open, which indicates generally bullish market sentiment.

Dogecoin Price Heading For Major Breakout

By press time, the Dogecoin price trades at $0.24, with an intraday gain of 4.93%. The recent price surge has triggered a bullish crossover between the 20-day and 200-day Exponential Moving Averages (EMA), which is a strong buy signal associated with an initial change in market dynamics.

In addition, the 50-and-100-day EMA slopes are on the verge of a bullish crossover, further reinforcing the upward momentum in price. With sustained buying, the coin price should rally 8% before challenging the multi-month resistance of the falling channel pattern.

Since December 2024, this chart setup has carried a sustained correction trend. Each retest of the upper boundary has led to a significant surge in selling pressure, dropping the price by 48-53%.

Thus, a potential breakout from the channel pattern is crucial for DOGE buyers to regain the $0.3 floor.

However, if the sellers continue to defend the downsloping trendline, the current correction could continue for the coming month.