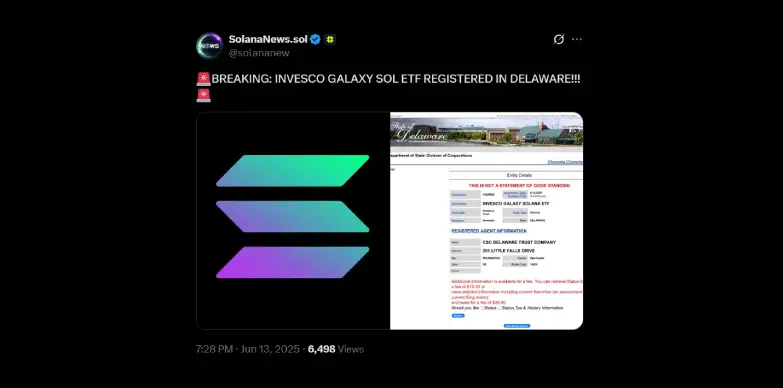

The Invesco Galaxy Solana ETF has officially filed for registration in Delaware, as reported today June 13, 2025. This filing signals a strategic push to bring Solana-focused investment products to U.S. markets. This move also indicates that there is a need for exposure that is beyond Bitcoin and Ethereum. As interest in altcoins continues to build, the move could pave the way for broader acceptance of Solana in traditional finance circles.

Delaware’s Strategic Role in Crypto ETF Launches

There is a reason because of which Delaware has been the preferred jurisdiction for fund registration in the United States. The state of Delaware provides a business-friendly regulatory environment, making it a strategic choice for launching innovative financial products like crypto ETFs.

Just like CoinShares, Invesco Galaxy also carried out registration of the Solana ETF in Delaware. Solana’s growing traction as a top-tier blockchain is becoming hard to ignore, with many seeing it as a serious challenger to Ethereum in the worlds of smart contracts and DeFi.

Growing Interest in Solana ETF

A Solana ETF would make it easier for traditional investors to tap into this momentum, offering regulated, hassle-free way to gain exposure to SOL’s price through familiar brokerage platforms, no crypto wallets or exchange accounts required.

This is in alignment with a broader trend where diversification in the ETF market has become important as the community now wants to invest in investment vehicles which are not Bitcoin and Ethereum ETFs. Invesco has also launched Bitcoin and Ethereum ETFs and now by filing for Solana ETF, it is clear that the company is trying to keep up with the trend and expand its digital asset offering for mainstream investors.

Regulatory Challenges and SEC’s Stance on Crypto ETFs

However, the regulatory hurdles still remain. The U.S. Securities and Exchange Commission (SEC) has been scrutinizing all the ETF applications that have been filed till now. There has been more attention towards ETFs that are beyond Bitcoin and Ethereum ETFs. This is because there are ongoing debates about the classification of these tokens which also include Solana as securities. Despite this, as of now, there are more than 70 ETFs applications filed with the SEC.

The Delaware registration shows that the company is getting ready to follow rules and protect investors.

More and more people are showing interest in Solana ETFs, which means that they trust the blockchain technology and see its future potential. If the ETF gets approved, it could lead to more crypto investment options and help digital assets become a bigger part of traditional finance.

Also Read: SharpLink Gaming Buys $463M ETH, Tops Public ETH Holders