Key Highlights:

- One of the early Hyperliquid whales offloaded almost 5 million HYPE tokens and made a profit of over $148 million.

- Hyperliquid is gearing up for an initial release of tokens worth $12 billion starting at the end of November.

- The increasing dominance of decentralized derivatives exchanges like Aster is stealing liquidity out of Hyperliquid.

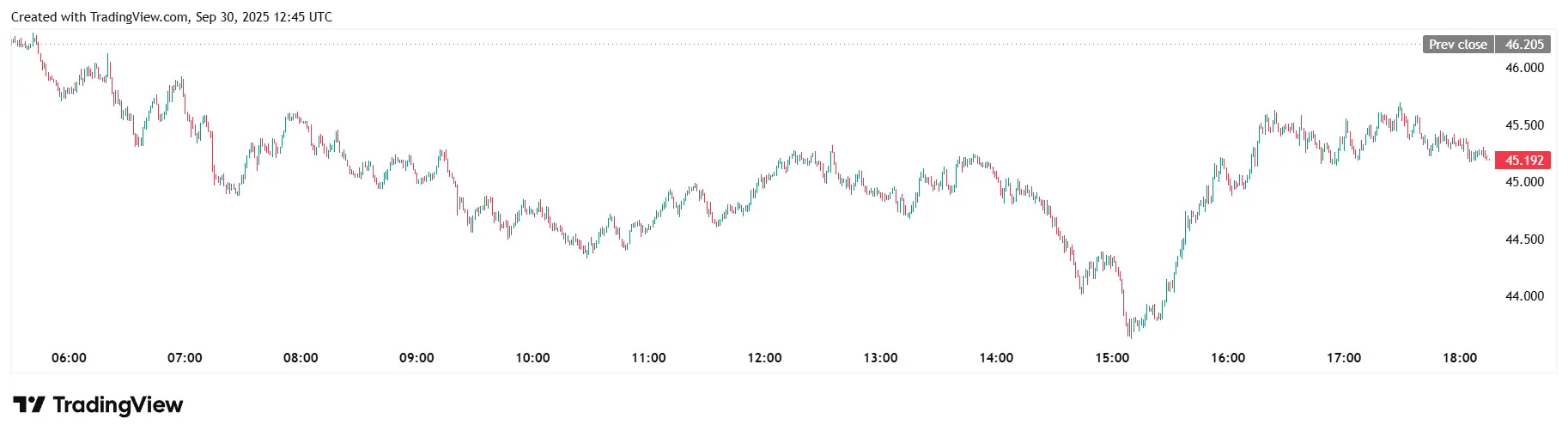

Another massive blow to the crypto market came on Tuesday when the HYPE token by the Hyperliquid project plunged hard. The token fell by over 8% today, which is linked to a massive sell-off by one of the high-profile holders.

HYPE Whale Rakes In Massive Profit

According to the on-chain data platform Lookonchain, the unidentified investor who initially had 5.07 million coins of HYPE nine months prior, sold almost his entire hold in a single transaction. The tracking platform reported that the whale sold 4.99 million tokens at an average price of $45.82 for a total of $228.76 million. The sale led to the realization of gains in the tune of $148.63 million.

The investor had accumulated the position when HYPE had been trading around $16.23, and that is where he has been hanging on to the rallies until this week, as he’s able to make gains. The account has had to part with the 77,089 tokens that it is holding following the divestment, which is currently worth approximately $3.37 million.

An early whale holding 5.07M $HYPE recently sold 4.99M $HYPE ($228.76M) at an average price of $45.82, realizing a profit of $148.63M.

He bought the 5.07M $HYPE 9 months ago at an average of $16.23.

Now he only has 77,089 $HYPE($3.37M) left. pic.twitter.com/4VK4HlrtMs

— Lookonchain (@lookonchain) September 30, 2025

This sale was shortly following the increased action around the NFT campaign at the exchange, Hypurr, which prompted over $45 million in trading the previous day. But the gigantic exit eclipsed that tide and raised concerns about concentrated holdings influencing the market. The movement of whales is not always left indifferent because of the possibility of influencing the direction of the price.

This was not the major limiting exposure to HYPE of this month. In September, BitMEX co-founder Arthur Hayes announced that he had sold tokens to the value of over $5 million, saying he was worried about how the exchange would tackle the unlock schedule.

Hyperliquid Eyes Enormous Token Unlock

The real test for Hyperliquid will begin when its unlock timeline comes near. A two-year linear vesting program has about 237.8 million tokens to be released beginning November 29. This is about $500 million of HYPE going into circulation every month. Analysts report that the amount of issuance may surpass the project token buybacks, putting pressure on the current supply.

Meanwhile, the decentralized perpetual exchange competitive environment is changing at an incredibly quick pace. Another competitor platform, Aster has been gaining momentum, with the platform backed by Binance founder Changpeng Zhao. In September, Aster had more user activity than Circle and Hyperliquid, indicating a possible redistribution of market share between derivatives-oriented decentralized exchanges.

These developments have been occurring at an opportune time, and this has raised doubts among the traders. Although in the short term, Hyperliquid was at highs of above $58 earlier in September, the later drop to the current levels of about $44 indicates that people are very cautious. There is market-wide weakness that has contributed to the downside, with most altcoins experiencing a failure to maintain gains following the spike in the market on Monday. However, the Hyperliquid price stabilized later in the day, trading at $45.18 with an itraday drop of 2.16%

This year, HYPE has been characterized by resilience in its price action, although there has been recent turbulence, observers say. The token stayed in an upward trend during bearish markets, and its rise to record levels in mid-September showed interest among investors. In the meantime, though, the focus still lies on whether the next wave of token unlocks and competition will keep their toll on its performance in the near future or not.

Also Read: Coinbase CEO Says, More Bullish on Clear Rules for Crypto