- Hyperliquid coin price gives a decisive breakdown below the support trendline of a falling wedge pattern.

- About 9.92 million HYPE tokens are set to unlock on December 29 under the project’s vesting plan.

- The potential bearish crossover between the 100-and-200-day EMA slope could accelerate the selling pressure in the market.

HYPE, the native token of decentralized perpetuals exchange, Hyperliquid slips over 7% during Wednesday’s market hours to trade at $24.9. While the downtick followed selling pressure in the broader market, the crypto observers are keeping a close eye on Hyperliquid amid the recent development. Earlier today, Hyper Foundation proposed a validator vote to formally recognize HYPE tokens held in the protocol’s Assistance Fund as burned. The coin price is anticipated for a bullish rebound as asset management companies are accelerating the process to launch a HYPE centric exchange traded fund.

Hyperliquid Price Drops as Token Unlocks Loom and ETF Buzz Grows

Over the past three weeks, the Hyperliquid coin price has witnessed a steep correction from $36.5 to current trading value of $24.7, registering for 32.3% loss. The pullback followed broader market uncertainty as Bitcoin struggles to sustain above $90,000.

Downward pressure increased as more token releases are scheduled this month. In line with Hyperliquid’s vesting program, approximately 9.92 million HYPE tokens would be unlocked on December 29, 2025. The move allocates supply to community rewards, core contributors, and emissions, but is considered slight bearish dues to supply-demand dynamics.

Despite the additional pressure, market observers are focused on the ETF development centered around HYPE. On December 15th, Bitwise Asset Management filed an amended S-1 filing for a spot Hyperliquid exchange traded fund, naming the annual management fee as 0.67% and naming it as BHYP for proposed listing on NYSE Arca.

In addition, on December 17, the Hyper Foundation started a validator vote to formally classify all HYPE tokens accumulated in the Assistance Fund as permanently removed from supply. These tokens, which are bought automatically using protocol fees, are stored in an inaccessible system address without a private key.

The address contains approximately 37 million HYPE at a value of almost $1 billion. Approval would remove them from both the circulating and total supply measures, which would amount to a reduction of circulating supply of approximately 11-13%. The vote ends on December 24.

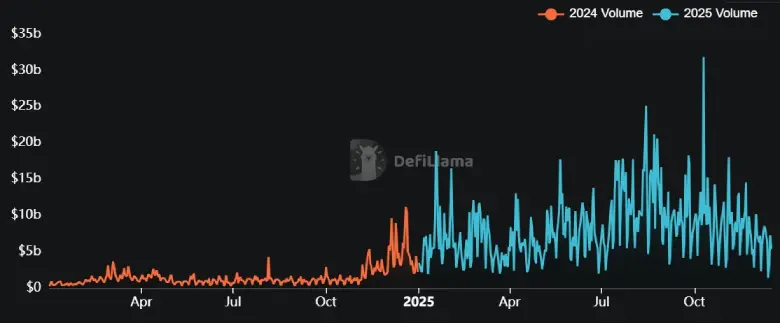

Hyperliquid’s decentralized perpetuals platform, HyperliquidX, has continued to dominate on-chain derivatives trading. It has been processing trillions in cumulative volume with heavy activity all the way through 2025 with multi-billion dollar daily figures recently.

Hype Price Give Bearish Breakdown From Multi-Months Support

With today’s price decline, the Hyperliquid price gave a bearish breakdown from the long-coming support trendline in the daily chart. Since mid-September 2025, the ongoing correction trend in this altcoin has been shaping within two converging trendlines with the formation of a falling wedge pattern.

Typically, the pattern reflects a weakening bearish momentum and potential for a bullish rebound in price. Therefore, the recent breakdown from key support accentuates the aggressive nature of sellers to drive a prolonged downtrend. If the daily candle closes below $25 mark, the selling pressure will accelerate and drive an extended drop of nearly 20% to hit the psychological level of $20.

A sharp downtick in daily exponential moving average (20, 50, 100, and 200) accentuates the negative sentiment in the market and potential for standard correction.

On the contrary note, if the coin price rebounds within the falling wedge pattern, the coin buyers could re-strengthen their grip over this asset to invalidate the bearish thesis.

Also Read: Hyperscale Data Allocates 97.5% of Market Cap to Bitcoin Holdings