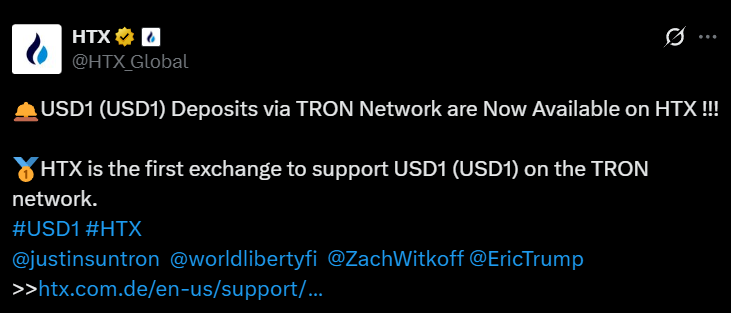

On July 7, the leading crypto trading platform, HTX announced the support for USD1, the stablecoin linked to Donald Trump’s World Liberty Financial, which will enable TRON-based deposits.

(Source: HTX On X)

With this announcement, HTX has become the first cryptocurrency exchange to support USD1 on Tron Network.

However, HTX mentioned that the stablecoin’s withdrawals on TRON will go live after reaching deposit thresholds, with no further notice.

What is USD1 Linked to World Liberty Financial?

USD1 is a USD-pegged stablecoin launched in March 2025 by World Liberty Financial (WLFI), a DeFi platform linked to US President Donald Trump. It is designed to maintain a 1:1 peg with USD.

It is backed by reserves of short-term US Treasury bonds and cash equivalents, similar to major stablecoins like USDT and USDC.

Currently operating on Ethereum and BNB Chain, the project has plans to expand to additional blockchains. Unlike its competitors, which primarily cater to retail users, the stablecoin is developed to be used as a solution for institutional investors and large-scale transactions. This will help the project to enhance security and cross-border transactions.

WLFI, the issuer behind USD1, ensures stability by holding low-risk assets and avoiding speculative yield strategies.

The stablecoin has already gained attention through high-profile deals, including a $2 billion transaction executed using a Trump-linked stablecoin. Like other fiat-backed stablecoins, it relies on arbitrage to maintain its peg.

The Political Backlash Against Trump-Linked Stablecoin USD1

Since its inception, WLFI and USD1 have been a hotbed for controversies. It is a soft target for critics to raise questions about the US President’s intention.

Recently, Senator Elizabeth Warren (D-MA) has amplified her warnings about cryptocurrency risks linked to Donald Trump, specifically targeting a UAE-backed $2 billion deal involving the former president’s family.

She argues that pending stablecoin legislation could enable potential corruption loopholes if passed, creating new vulnerabilities in the financial system.

Warren stated in a post on X, “The Trump family stablecoin surged to the 7th largest in the world because of a shady crypto deal with the United Arab Emirates—a foreign government that will give them a crazy amount of money. The Senate shouldn’t pass a crypto bill this week to facilitate this kind of corruption.”

Earlier, Former President Donald Trump welcomed major investors of his namesake memecoin, $TRUMP, at an exclusive dinner event this week. This has attracted immediate backlash from Democratic lawmakers and protesters who slammed it as “pay-to-play” politics.

Senator Chris Murphy stated that there are bribes disguised as investments, while protestors outside waved signs reading “Stop Crypto Corruption.”

Also Read: Trump-Linked WLFI Awaits Nod for Token Trading via Voting