Key Highlights:

- OKX has launched ZEN/USDC and ZEN/USDT pairs.

- ZEN’s zero-knowledge (zk) feature and compliant privacy makes it alluring to the investors.

- ZEN is trading above key support, showing short-term potential and long-term resilience.

Horizen’s native token $ZEN is back in focus this week after OKX added new trading pairs for it. From November 17 and 18, 2025, the exchange launched ZEN/USDC and ZEN/USDT markets, a move that indicates confidence in privacy-focused blockchain.

The USDC pair is important here as it lets traders buy and sell ZEN directly against a widely used stablecoin, reducing reliance on Bitcoin and Ethereum price swings. This improves liquidity and market access, potentially encouraging arbitrage and attracting traders who prefer stablecoin trading. Listings like this usually provide mid-cap altcoins like ZEN a short-term price push, as more liquidity helps breakout moves.

The listing also fits Horizen’s strategy shift earlier this year toward scalability and interoperability. The project has started moving its infrastructure to Base, which is Coinbase’s layer-2 network, which supports Ethereum tools and faster transactions.

OKX’s timing may show rising institutional interest in Horizen’s growing ecosystem, aiming to be more than a privacy network and a compliant zero-knowledge tech provider.

Privacy Tokens Regain Market Traction

ZEN’s rally has come at a time when the privacy focused cryptocurrencies are in the spotlight. Tokens such as Zcash (ZEC), Dash (DASH), and Horizen have all gained between 100% and 200% throughout November 2025. It has been established that investors are now rotating money from assets such as Bitcoin to privacy focused (tokens that use zk technology to shield transaction details) tokens as new emphasis is being provided on user data protection.

Horizen’s technology stack already includes k-SNARKs, the same cryptographic framework pioneered by Zcash, which allows shielded transactions (hidden sender and receiver details) and maintain anonymity while remaining verifiable on-chain. The main aim of the project is to make sure that the services that are provided by this blockchain are “privacy compliant.” The project allows selective disclosure so that it can satisfy regulatory requirements, this feature has made it more palatable to mainstream investors.

However, this wave of momentum carries policy risk. The European Union’s proposed 2027 regulatory framework, which could limit the trading or circulation of privacy coins on centralized exchanges, and it remains as a major overhang. Any progress on such legislation could dampen long-term optimism.

For now, traders are looking out for shielded supply metrics closely as 30% of Zcash’s circulating supply is fully shielded, and growing share of Horizen being held or used in private wallets would mean more people are actually using its privacy functions, not just trading it.

Technical resilience with cautious optimism

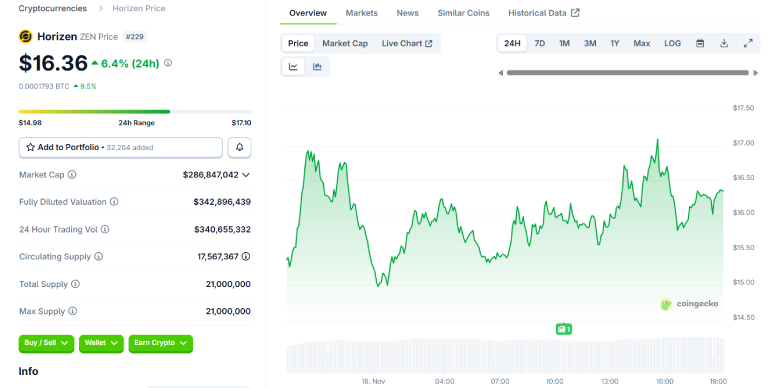

If you look at it from a technical point of view, ZEN is currently trading around $16. This value is however above its 30-day simple moving average of $14.31 and its pivot point at $15.18. The Relative Strength Index reflects 54.26 which means that there is a balanced situation where the token is neither overbought or oversold. The Moving Average Convergence Divergence (MACD) indicator remains negative at -0.385.

Traders see $15.95 as the critical Fibonacci support level (61.8%) retracement. A sustained price floor here could set the stage for a retest of the next key resistance band at $17.67, which corresponds to the 50% retracement level. If the bullish momentum prevails, ZEN may target $19.35, which is in line with 38.2% retracement.

On the contrary, if there is a breakdown below $15.18, the token could experience a deeper pullback toward $13.58 (78.6% retracement), and its recent gains might disappear.

At press time, the price of the Horizen’s native token ZEN stands at $16.36 with an uptick of 6.4% in the last 24 hours as per CoinGecko.

Outlook

ZEN’s 24-hour surge shows how exchange listings can push projects. OKX has listed the project at a time when the entire world is interested in privacy tokens. Traders are on a lookout for the $17-19 resistance zone and daily ZEN/USDC volume to gauge momentum. The project’s zero-knowledge tech and Base L2 integration make ZEN a resilient, mid-cap privacy token.

Also Read: Zcash Jumps More Than 10% on $50M Corporate Buy-in and Privacy Boost