Ethereum, the second-largest cryptocurrency by market cap, showed a slight uptick of 0.88% during Monday’s U.S. market session. The intraday jump forms a short-bodied, low-volatility candle, indicating that prevailing market uncertainty influences the ETH price. This consolidation is nearing a major resistance level, signaling a potential pivot movement for the asset to change its direction. Will the asset break the $2,000 barrier or plunge to the $1,500 floor?

On-Chain Activity Signals Waning Interest from Large Transactions

Over the past five months, the Ethereum price has shown a steady correction trend from $4,108 to $1,827, its current trading value, registering a loss of 55%. The falling price resonated strictly within two parallel trendlines, which acted as dynamic resistance and support against traders.

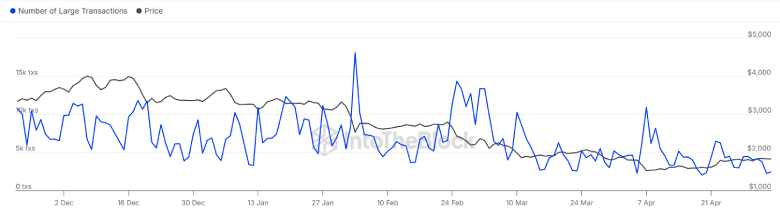

Simultaneously, ETH’s on-chain activity has witnessed a notable shift in recent months, as large transactions above $100,000 have significantly declined. According to IntotheBlock data, the number of large transactions peaked at 18.07 transactions per day in February 2025 but has since plummeted to just 2.46 transactions per day.

This sharp reduction signals a waning interest from high-volume traders or institutional investors in Ethereum, which could be attributed to various factors, including ETH underperformance, diplomatic tension around tariff deals, and regulatory concerns.

If the trend persists, the coin price will struggle to drive a sustained recovery in the near term.

Ethereum Price Poised to Challenge Major Resistance

An analysis of Ethereum’s daily chart shows a consolidation trend within the 20-and-50-day Exponential Moving Averages. The sideways action showed multiple short-bodied candles with price rejection on either side, indicating a lack of initiation from buyers or sellers.

The renewed recovery in Bitcoin could push the ETH price above the 50-day EMA slope and bolster a 4.6% surge to challenge channel resistance at $1,932. In recent months, this overhead resistance has reinforced sellers to raise bearish momentum, which led to corrections ranging from 24% to 38%.

If history repeats, the coin price would show presence by selling with rejection candles before driving a 27% fall to retest $1,400.

On the contrary, a potential breakout from the overhead resistance will signal a change in market direction and push Ethereum past $2,850.