On Monday, June 2nd, the Bitcoin price fell another 1.4%, extending its correction to $104,297. The selling pressure could be linked to FUD around Jerome Powell’s speech at the 75th Anniversary Conference, Federal Reserve Board, and President Donald Trump’s demands for final trade deals from countries by Wednesday. While the near term hints at a prolonged correction ahead, the accelerated adoption of BTC signals a quicker rebound.

Institutional Adoption Counters Bitcoin Price Correction

Over the last two weeks, the Bitcoin price has declined from $111,816 to $104,551, representing a 6.5% loss. The correction momentum continued on Monday’s U.S. market session as investor speculation surged around Jerome Powell’s speech at the Fed’s 75th Anniversary Conference and rising social media rumors of his resignation.

The market uncertainty further accelerated as Donald Trump demanded that countries offer their trade deals by Wednesday to avoid the reinstatement of tariffs.

Despite mounting selling pressure, institutions continue to race to adopt BTC.

According to a recent announcement, Russia’s largest bank, Sberbank, has introduced structured bonds that track Bitcoin and USD/RUB exchange rates. The offering is available over the counter (OTC) to qualified investors, and transactions are settled in rubles within Russia’s legal framework.

Additionally, Sberbank plans to launch Bitcoin futures products on June 4 through its investment arm, SberInvestments.

According to a recent filing with the U.S. Securities and Exchange Commission (SEC), Hong Kong-based Reitar Logtech Holdings Ltd. revealed plans to purchase up to $1.5 billion worth of Bitcoin (BTC). The logistics tech firm aims to use Bitcoin as a hedge strategy against traditional market volatility.

Adding to the wave of adoption, Michael Saylor’s firm, Strategy, announced its plan for an initial public offering of STRD stock. Thus, the fund would be dedicated to buying more Bitcoin.

These collective developments bolster BTC’s demand pressure and could soon overthrow the market selling pressure.

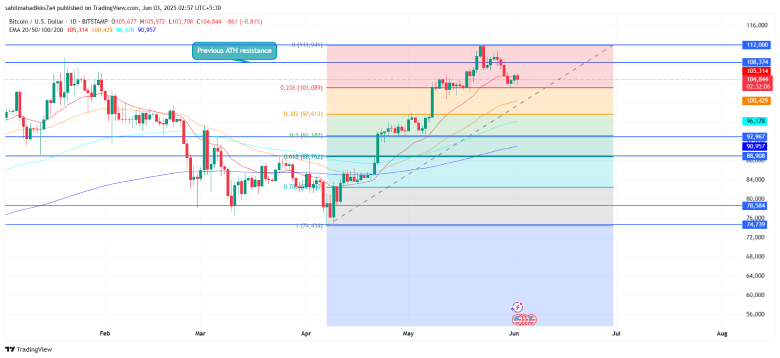

Fibonacci Tool Mark Major Support For Bitcoin

In the daily chart, the Bitcoin price correction shows a potential support test at $103,200— a level coinciding closely with the 23.6% Fibonacci retracement level. If sellers breach the horizontal support, the price could plunge to $97,600 and $93,000, which aligns with 38.6% and 50% FIB.

While the prolonged correction may shake retail investors, the aforementioned levels are suitable footholds for buyers to regain bullish momentum. The upward-sloping 200-day EMA further accentuates the broader bullish trend in BTC.

Thus, the Bitcoin price would likely rebound from any of these supports to rechallenge the all-time high resistance of $112,000.

On the contrary, a breakdown below the 50% retracement level at $93,000 will signal a bearish shift in the BTC trend.

Also Read: Crypto Holds Strong as Tech Stocks See Outflows: QCP Report