SOL, the native cryptocurrency of the Solana ecosystem, plunged over 2% on Thursday to reach a $143 trading price. This bearish momentum accelerated as United States President Donald Trump approved an attack on Iran, escalating the geopolitical tension in the Middle East. Along with a broader market pullback, the active addresses on SOL take a major hit, signaling a risk of a prolonged downtrend.

Solana On-Chain Activity Declines Sharply

Over the past week, the Solana price has experienced a notable downturn, dropping from $168 to $143, resulting in a 7% loss. The correction trend likely followed the broader market pullback as military action in the Middle East continued to escalate.

According to a recent news report, one of America’s top aircraft—the E-4B Nightwatch, also known as the “doomsday plane”—was seen taking off on Tuesday amid the alarming concern of the United States getting involved in the Iran-Israel war.

Thus, a majority of major cryptocurrencies, including Solana, face the risk of a prolonged correction in June 2025.

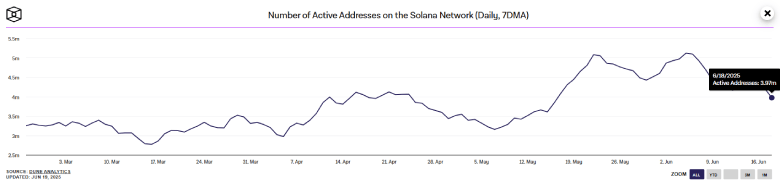

Along with price correction, the number of active addresses on the Solana network plunged from 5.12 million to 3.97 million—a 22% decline—in the last two weeks. This drop typically indicates fewer users interacting with dApps, staking, or transferring tokens on the SOL network, reflecting reduced demand or interest.

If the trend resumes, crypto buyers may struggle to maintain momentum, potentially leading to a continuation of the price trend.

Bearish Chart Setup Hints at Deeper Breakdown Below $140

The daily further chart analysis shows a downward trend with a lower high formation at $187, before the price plunged 22% to $145. A series of such lower-high formations are often spotted during an established downtrend, signaling a sell-the-bounce sentiment in the market.

A deeper analysis of the technical chart also revealed the potential formation of a head-and-shoulders pattern. This chart setup consists of three peaks: the left shoulder, the middle head, and the right shoulder.

Currently, the Solana price is just 3% short of a bearish breakdown below the pattern’s neckline support of $140. Considering the mounting geopolitical tension in the Middle East, the SOL price is likely to breach this support and accelerate its downtrend by 20% to hit $116.

On the contrary, if the coin buyers continue to defend the pullback support at $140, the price could rechallenge the overhead trendline, potentially leading to a breakout and invalidating the bearish thesis.

Also Read: Crypto is Not a Threat to Dollar: Treasury Secretary Bessent