SEI, the native cryptocurrency of the layer one blockchain Sei, has been in investors’ spotlight since last week due to a record surge in its network activities. However, the asset price shows a slowdown in recovery momentum and shifts its movement sideways. With an intraday loss of 1.03%, the altcoin plunged at the $0.27 mark, creating market concern over whether the SEI price has hit overbought levels.

Sei Network Leads Web3 Gaming With 8.8M Wallet Surge

In the last two weeks, the SEI price showcased a significant recovery from a $0.143 low to a high of $0.336, which registered a 112% gain. Along with the broader market upswing, the recent registration of the Canary Staked SEI ETF in Delaware triggered the initial push in this recovery.

The bullish momentum further accelerated as SEI’s Web3 games attracted hundreds of thousands of players, yielding millions of transactions on the network. According to DappRadar data, the SEI emerged as the most active gaming chain over the last 30 days, with a massive 8.8 million unique wallets, representing a 74% growth.

In June 2025, 14 games on SeiNetwork surpassed 100,000 unique active wallets, highlighting strong user engagement.

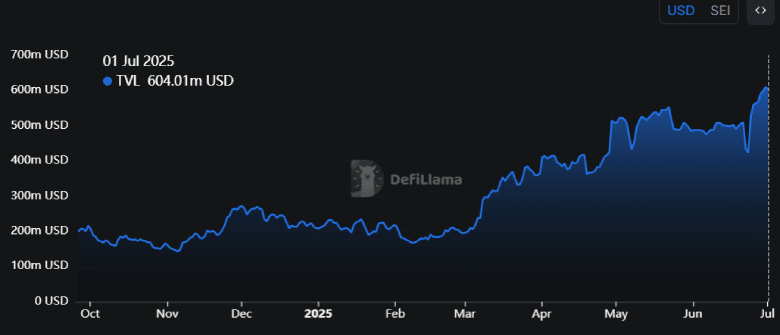

Furthermore, the DefiLlama data highlights a continued uptrend in the SEI’s total volume locked (TVL), recently surpassing the $600 million milestone. The surge indicates that users are aggressively locking their assets in the network’s DeFi protocols, suggesting higher trust in its ecosystem stability and yield potential.

This sustained trend could further attract demand pressure in this asset and drive higher recovery.

SEI Price Signals Major Reversal Amid Cup and Handle Pattern

Since last week, the SEI coin recorded a short pullback from a $0.336 high to the current trading price of $0.27, accounting for a 14% loss. This correction aligns with the broader market slowdown and Bitcoin experiencing overhead supply at $108,000.

However, the momentum indicator RSI also plunged to 60%, which indicates the buyers could recuperate the exhausted bullish momentum. Furthermore, a deeper analysis of the daily chart shows the decline in price leads to a potential formation of a renowned reversal pattern called a cup and handle. The pattern is commonly spotted in major market towns, signaling a prolonged accumulation zone in an asset before a new recovery trend.

Therefore, the SEI coin could be at the beginning of a major recovery. A successive breakout above the $0.36 neckline will complete this pattern and bolster a recovery trend to the $0.5 mark