Key Highlights

- On November 14, Grayscale officially announced the launch of its XRP Trust ETF on NYSE Arca

- With the launch, Grayscale is adding its new crypto ETP in the latest wave of XRP ETFs by major issuers, like Bitwise, 21Shares, and Franklin Templeton

- The launch comes while the crypto market is going through a downward trend, with XRP declining to $2.09

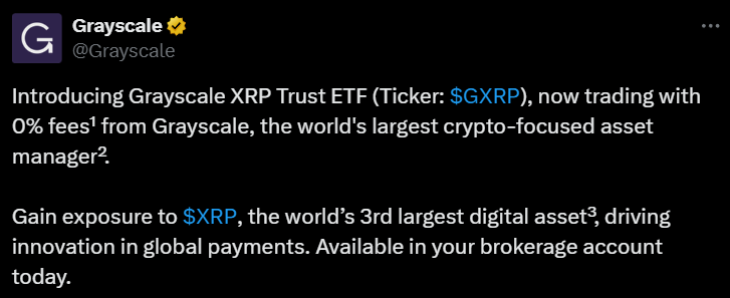

On November 14, Grayscale announced the launch of the Grayscale XRP Trust ETF on NYSE Arca, following the new wave of XRP ETFs.

(Source: Grayscale on X)

The launch of Grayscale’s XRP ETF comes amid the dip in the cryptocurrency market. At the time of writing, the cryptocurrency is trading at around $2.08 with a 5.9% drop on a weekly chart, according to CoinMarketCap.

Grayscale’s XRP ETF Goes Live

The newly launched Grayscale XRP Trust ETF, trading under the ticker GXRP, is now live on the NYSE Arca exchange. This launch comes after its official clearance from the SEC and the exchange on November 21.

This ETF allows investors to get exposure to the price of XRP directly without even holding the cryptocurrency.

For investors, this new ETF will be accessible through standard brokerage accounts. This makes the process easy for both individuals and institutions.

“GXRP’s debut on NYSE Arca is another meaningful step in broadening access to the growing XRP ecosystem,” 4Krista Lynch, Senior Vice President, ETF Capital Markets at Grayscale, stated in a press release. “GXRP is designed to offer efficient tracking and straightforward exposure to XRP for investors.”

A rapid-fire series of spot XRP ETF launches throughout November has started a new chapter in the cryptocurrency’s history. This wave started on November 13 with an impressive debut of Canary Capital’s ETF (XRPC), which fetched over $250 million of inflows during its first trading day.

These impressive inflows show that XRP is a hot favourite digital asset for institutional investors.

After the launch of the first XRP ETF, the momentum continued with major ETF issuers like Bitwise, 21Shares, and Franklin Templeton as they started rolling out their ETFs. Owing to this, the launch frenzy culminated with 7 distinct XRP ETFs hitting the markets in less than 2 weeks, which was a historic event that propelled the price of XRP above the $2 mark amid significant buying from large-scale investors.

“In 2025, we’re watching digital assets take on real utility in the global economy, whether powering payments or tokenizing real-world assets,” Bitwise CEO Hunter Horsley said. “With today’s launch of the Bitwise XRP ETF, we’re excited to help investors gain exposure to a longstanding asset that has the potential to fundamentally reshape how institutions move money and other assets worldwide.”

“The timing of this ETP launch is exciting,” said Bitwise CIO Matt Hougan. “For years, XRP’s real-world potential was stunted by an extremely hostile regulatory environment. But now, with that obstacle removed—and buoyed by a passionate investor base—we believe we will finally get to see what XRP’s technology can really do.”

Crypto Market Faces Turbulence Despite Growth in Crypto ETPs

At present, the cryptocurrency market is facing extreme volatility, which has pulled down major cryptocurrencies like Bitcoin, Ether, Solana, XRP and others.

This downward trend in the crypto market started after U.S. President Donald Trump announced a 100% tariff on China. After this, the crypto market has witnessed the biggest liquidation of the crypto market’s history, wiping out $19.16 billion instantly, according to Coinglass.

XRP is currently trading near $2.09, finding solid support as its key momentum indicator trends upward on the daily chart. The rising Relative Strength Index, now at 39, shows that bullish momentum is gathering strength, with buyers successfully defending the crucial $2.0 price level. Maintaining a daily close above this psychological barrier would also trigger positive market sentiment. It could also increase the likelihood of a sustained upward momentum.