What to Know

- Google boosts stake to 14% in TeraWulf, becoming its largest shareholder.

- TeraWulf pivots from to AI infrastructure, expanding Lake Mariner campus with Fluidstack to 360 MW capacity.

- Analysts raise price targets, citing Google’s backing and long-term growth in AI and HPC hosting.

Google has increased its stake in TeraWulf Inc., a U.S.-based bitcoin miner and emerging data center operator, to about 14%. This makes Alphabet Inc. the company’s largest shareholder and shows that they believe in the future of blockchain-infused AI infrastructure. With this new investment, Google’s total financial support is now about $3.2 billion.

TeraWulf’s stock immediately increased in response to the news, rising by over 15% at one point to levels not seen since March 2022. Despite this strong performance, the stock later flattened and retraced slightly, ending the day with a modest 3% decline in early trading. This suggests that investors are very interested, but they may be taking profits or being careful.

Google’s AI Expansion

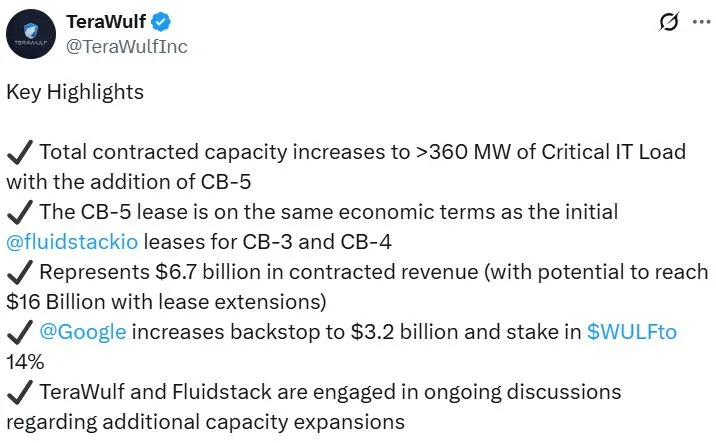

The increased backing fits with TeraWulf’s big plan to expand its Lake Mariner data center campus. Fluidstack, an AI platform backed by Google, is going to build a new facility called “CB-5” that will add 160 MW of computing power starting in late 2026. This extends Fluidstack’s operational footprint to 360 MW across the campus, strengthening TeraWulf’s role in AI and HPC infrastructure. TeraWulf CEO Paul Prager said in a release that the agreement solidifies the company’s “strategic alignment with Google” to help build advanced artificial intelligence infrastructure.

Source: Terawulf on X

Following the strategic move and pivot toward AI infrastructure, several analysts upgraded their price targets. B. Riley raised its target from $8 to $14, while others like Rosenblatt, Citizens JMP, and Clear Street cited the transformative potential of this partnership, especially in reducing financial risk and supporting growth.

TeraWulf started out as a bitcoin miner that was good for the environment, but now they want to do well in the AI and HPC hosting business as well. TeraWulf is putting itself at the crossroads of energy-efficient crypto mining and next-gen AI computing with long-term leases from Fluidstack and money from Google.

Google’s Financial Strategy

Google is not only raising its stake, but it is also building financial structures that will make TeraWulf’s future stronger. The most recent move adds a $1.4 billion incremental backstop to a previous $1.8 billion commitment, bringing the total to $3.2 billion and increasing its ownership to about 14%. This backstop isn’t just money; it also includes warrants for 32.5 million new shares. This gives Google more options and room to grow as TeraWulf does.

This “layered lock-in” means that Google has a stake in both the capital and the execution. It lowers TeraWulf’s debt risk and shows that one of tech’s most trusted brands is committed. For Google, it protects its computing infrastructure, which is a smart way to protect against AI demand.

Aligning with the AI Demand

Beyond mining, TeraWulf is architecting infrastructure for the AI age. Fluidstack, backed by Google, has expanded its lease at Lake Mariner, adding the CB-5 facility that brings total committed capacity to 360 MW of critical IT load, translating to about $6.7 billion in contracted revenue, with the potential to reach $16 billion via extensions.

Deployments begin in 2026 with 40 MW online and full buildout by year-end. TeraWulf is perfect for high-density AI workloads because of its renewable energy-powered, low-carbon, liquid-cooled infrastructure. Google is supporting an enterprise-grade AI ecosystem and safeguarding computational infrastructure at the same time. TeraWulf is transformed from a Bitcoin-focused play to a crucial component of the AI compute layer by this high-margin, long-duration contract framework.

Final Thoughts

Google’s decision to become the largest TeraWulf shareholder shows how crypto infrastructure and AI-driven computing needs are coming together more and more. Google is showing that it trusts TeraWulf’s move from bitcoin mining to mainstream digital infrastructure by working with Fluidstack and supporting the expansion of new data centers.

If it works out, TeraWulf could show how blockchain platforms can grow into important parts of AI and Web3 services, which would boost both crypto gains and tech innovation.

Also Read: Ethereum ETF Inflows Hit $2.85B as Bitmine Buys $1.62B ETH