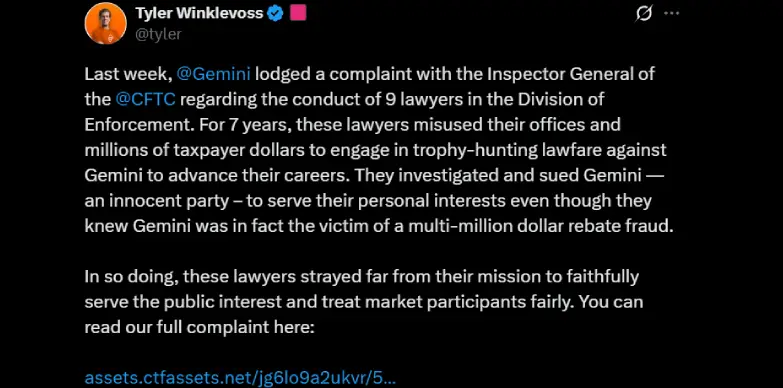

The conflict between cryptocurrency exchange Gemini and the U.S. regulators has intensified, as Gemini has filed a comprehensive complaint with the Inspector General of the Commodity Futures Trading Commission (CFTC). According to Tyler Winklevoss, the complaint was submitted last week and nine lawyers within the CFTC’s Division of Enforcement (DOE) have been accused of a seven-year campaign of misconduct, abuse of authority, and misuse of taxpayer funds in their investigation and prosecution of Gemini.

Allegations of False Whistle blower and Misguided Investigation

According to the filing, the CFTC’s enforcement attorneys were after Gemini based on what the company describes as a “false whistle blower report” from former employee Benjamin Small.

The exchange alleges that even though there was a clear evidence that Small’s claims were nothing but pure fabrication-and that he has had documented history or fraud- the DOE pressed forward with its investigation and legal action, disregarding facts that would have exonerated the company.

Neglect of Actual Perpetrators and Abuse of Legal Privileges

Gemini also says that CFTC went after them instead of targeting real culprits behind a multi-million dollar rebate scam-Hashtech LLC, Cardano Singapore PTE Ltd., and their leaders. According to the exchange, the agency did this to get media attention and help certain staff members boost their own careers.

Double Standards and Alleged Interference in Business Operation

Gemini also claims that the DOE used legal privileges to hide key evidence that could have helped their case, making it hard for them to properly defend themselves against the CFTC’s accusations.

The company also says there’s a double standard-while they were heavily penalized for accidental mistakes, DOE staff got away with making false statements in other situations. On top of that, Gemini alleges senior DOE officials delayed a separate business application from one of its affiliates to pressure them into settling the case.

Settlement and Calls for Reform

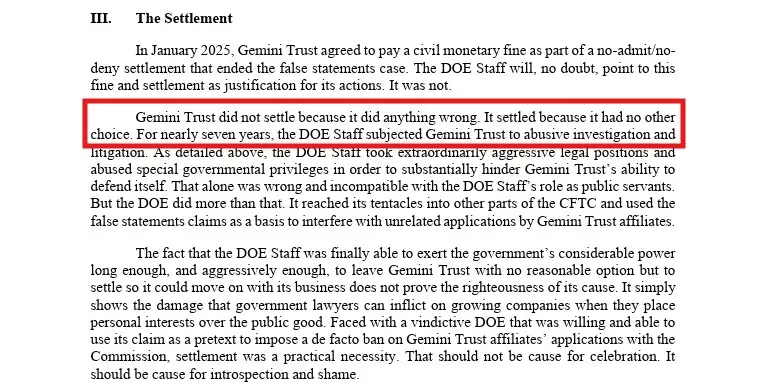

In January 2025, Gemini agreed to pay a civil penalty to settle with the CFTC but did not admit to doing anything wrong. The company says it only settled because of the DOE’s pressure tactics, not because it had actually broken any rules.

Gemini is now calling for major changes at the CFTC, pointing to a toxic work culture and lack of accountability. They have asked the Inspector General to look into the matter to help public trust and stop this kind of behaviour from happening again.

Also Read: Thailand Eyes Crypto Growth with 5-Year Tax Waiver