Key Highlights:

- FLUID surged over 50% within 24 hours following its listing on Upbit.

- Trading volume skyrocketed as FLUID became available against KRW, BTC and USDT with regulatory measures.

- Upbit’s listing hype is real.

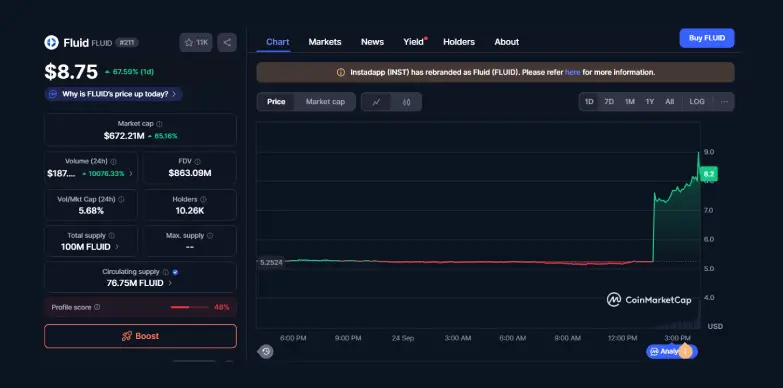

Fluid (FLUID), a DeFi liquidity aggregator protocol, managed to jump more than 50% in the last 24 hours. This jump adds to its strong weekly rise of 50.8%. The main boost came from FLUID’s listing on a well-known South Korean exchange, Upbit. This listing, along with other multi-chain growth and better tokenomics, has renewed investor confidence in the token.

At press time, the price of the token stands at $8.75 with a surge of 67.59% in the last 24 hours as per CoinMarketCap.

Upbit Listing Hype is Real, Fuelling Massive Price and Volume Surges

The highly anticipated listing of FLUID on South Korea’s leading cryptocurrency exchange, Upbit, officially went live on September 24, 2025, at 10:30 UTC. This launch followed Upbit’s standard five-minute order book pre-opening period and introduced FLUID trading pairs against the Korean Won (KRW), Bitcoin (BTC), and Tether (USDT).

In the first hours after its listing, FLUID’s trading volume shot up by 700% and it hit about $145 million. The token’s price climbed to roughly $7.24; such a sharp rise confirms the excitement that surrounds this listing.

The Upbit listing hype is getting real these days. It has been observed recently that tokens have been experiencing rapid price jumps after being listed on Upbit. Tokens like $MOODENG surged more than 55%, $OMNI skyrocketed to 170%, $TREE token rallied 90%, and other tokens such as $SOON, $DEEP, and $WCT also experienced significant rallies after their Upbit listing.

Upbit has a strong reputation in South Korea and a huge user bas,e which makes every new listing a big deal. The platform also attracts both everyday traders and bigger investors. The exchange controls wild price wings at first with limits, but excitement and heavy trading still take off quickly. For FLUID, getting listed on Upbit unlocked a major new source of trading activity, pushing it far ahead.

Enhancing Multi-Chain Reach with Solana Integration

The other incident that is backing FLUID’s rise is its recent move into the Solana ecosystem. On September 22, 2025, FLUID launched liquidity pools on Solana’s Meteora and Jupiter DEXs, which added to its strong base on Ethereum and Arbitrum, where it ranks among the top-4 lending protocols.

Solana’s low fees and fast network fit well with FLUID’s liquidity model, which allows quicker and cheaper trades. As Solana’s DeFi TVL is near $4.6 billion, the token gains new users and revenue by entering this space. This multi-chain growth broadens its reach and increases overall market strength.

Tokenomics Boost via Buyback Plan

FLUID has also rolled out a buyback plan, which was first announced on August 19, 2025. The project has set aside about $30 million each year from its revenue so that it can buy back tokens from the open market. This will cut down the number of tokens in circulation and make them scarce. In this way, the price of the token will be on the rise.

FLUID’s recent Relative Strength Index (RSI-14) is at 38.2, which indicates that it is not overbought and it could still rise if the buybacks go through. But there are risks involved. If the revenue goals are not met, investors may sell off in today’s cautious market.

FLUID’s recent price jump comes from various good news points, its big Upbit listing that opened doors for more traders, its move into Solana network for faster and cheaper transactions, and a buyback plan that could make tokens more scarce. All of these factors combined have brought fresh attention to the token, helping it surge while most of the crypto market remains flat.

Also Read: Aster Overtakes Hype as Futures Open Interest Tops $1.2B