SOL, the native cryptocurrency on the Solana network witnessed a 2.85% surge during Tuesday’s trading session to reach $145. The bullish momentum can be attributed to the broader market uptick and the recent filling of the 19-4 form by CBOE for Fidelity’s Solana fund. As the speculation around spot SOL ETF grows, the coin eyes a major breakout to restore prevailing recovery.

Key Highlights:

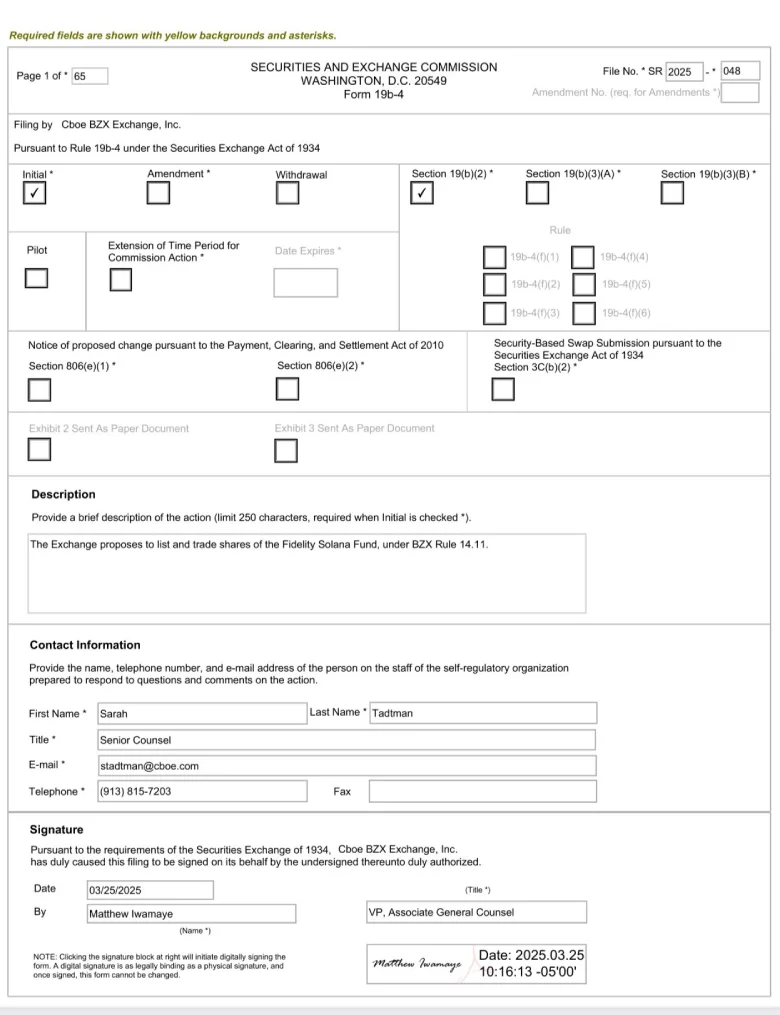

- Fidelity has filed a Form 19b-4 with the SEC to launch a Spot Solana ETF via Cboe BZX.

- Solana price breakout from the 20-day Exponential Moving Average signals a change in market dynamics and a +20% surge ahead.

- The SOL price trading below daily EMAs (20, 50, 100, and 200) indicates the path to least resistance is down.

Fidelity Files for Spot Solana ETF with the SEC

On Tuesday, March 25th, Fidelity officially filed a Form 19b-4 with the U.S. Securities and Exchange Commission (SEC) through the Cboe BZX Exchange, seeking approval to list and trade shares of a Spot Solana Exchange-Traded Product (ETP) under the name “Fidelity Solana Fund.”

Fidelity joins the growing list of asset managers, such as Grayscale, Franklin Templeton, Bitwise, Canary Capital, 21Shares, and VanEck that have sublimated a filing to launch their own Solana ETF.

According to the filing, the proposed ETF aims to list under BZX Rule 14.11(e)(4), which governs Commodity-Based Trust Shares.

If approved, the Fidelity Solana Fund could offer institutional and retail investors a regulated gateway to Solana exposure without directly holding the token, potentially unlocking significant capital inflows into the Solana ecosystem.

Following the filling, the SOL price records a 2.56% jump and shows its sustainability above the fast-moving 20-day EMA slope.

SOL Price Breaks Key Barrier for +20% Surge Ahead

Amid the market relief rally, the Solana price bounced from $112 to $145 current trading value — a 30% increase — in the last two weeks. This upswing breached the immediate barrier of $136 and the dynamic resistance of the 20-day EMA slope.

Since late January 2025, the SOL price has struggled to close a two-day candle above this EMA slope which resulted in accelerating selling pressure and a prolonged downfall.

Thus, if today’s price manages to sustain above the $135 level, the buyers would gain stable support to drive a 23% surge and challenge major resistance at $178.

On the contrary, the Solana coin still trades below the 100-and-200-day EMA slope suggesting the broader market trend is bearish. Thus, the market buyers must brace for an occasional pullback before the price can reclaim the $178 level.

Also Read: Bitcoin Billionaire Resurfaces With $284M Buy — Is BTC’s 60-day Correction Over?