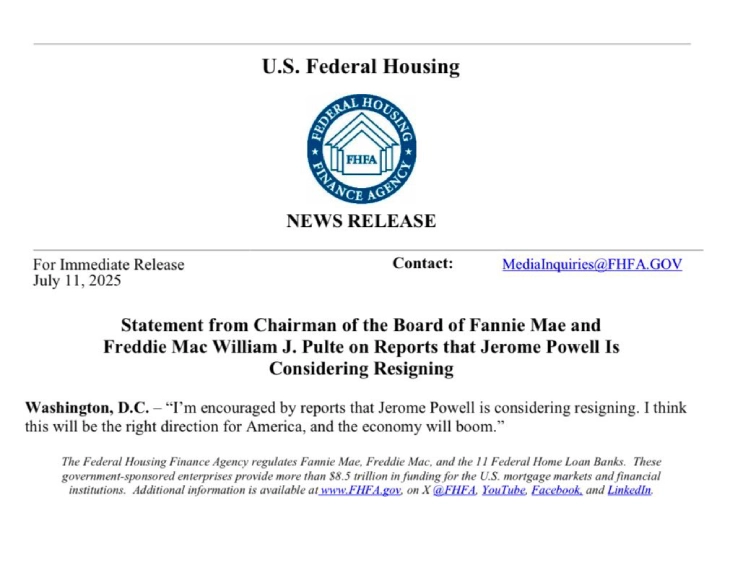

The Chairman of Fannie Mae’s Board has publicly ‘encouraged’ reports that Federal Reserve Chair Jerome Powell may step down, calling it “the right decision for America, and the economy will boom.”

(Source: Pulte on X)

The statement comes amid ongoing debates over monetary policy and its impact on the US economy.

Jerome Powell Faces Fire From Trump

The statement comes after President Trump’s budget director, Russell Vought, slammed the Federal Reserve Chair on Thursday, accusing him of badly running the Fed and lying to Congress about expensive renovations at the Fed’s headquarters.

This attack adds to Trump’s ongoing criticism of Powell, who has refused the president’s demands to lower interest rates. Trump has even talked about firing Powell or picking his replacement early, well before Powell’s term ends next spring.

Federal Reserve Chair Jerome Powell is not explicitly hostile toward cryptocurrency, but his “cautious approach”, especially his refusal to cut interest rates, has been damaging to the crypto market.

While Powell has softened some of the Fed’s restrictive policies, acknowledging Bitcoin’s maturity and even supporting bank involvement in crypto under strict rules, his insistence on keeping rates high has hindered growth.

Usually, crypto grows in a low-rate environment where investors seek higher-risk assets. But Powell’s inflation fight has kept borrowing costs elevated.

Earlier, Powell stated that banks can provide cryptocurrency services to customers, so long as it’s done safely and soundly. He said, “We’re not against innovation, and we certainly don’t want to take actions that would cause banks to terminate customers who are perfectly legal just because excess risk aversion may be related to regulation and supervision.”

“The President is extremely troubled by your management of the Federal Reserve System,” Russell Vought wrote in a letter. “Instead of attempting to right the Fed’s fiscal ship, you have plowed ahead with an ostentatious overhaul of your Washington D.C. headquarters.”

According to Raymond James policy analyst Ed Mills, the recent complaints over the Fed’s expensive building renovations could indicate the White House is preparing a case to remove Powell from his position.

“The Supreme Court has made it very clear in their rulings that they would not support the president firing Powell,” Mills stated. “So they can either find a reason to fire him for cause, or you create enough of a negative environment that Powell says, ‘it’s no longer worth it, I’m out.’”

Also Read: “Big Week Coming Up”: Bo Hines