- Ethereum price reversal from $2,150 resistance has bolstered sellers for an extended downtrend to $1,620.

- The higher-than-expected U.S. nonfarm payrolls for January has reduced market expectation for rate cut in March, negatively impacting the crypto market.

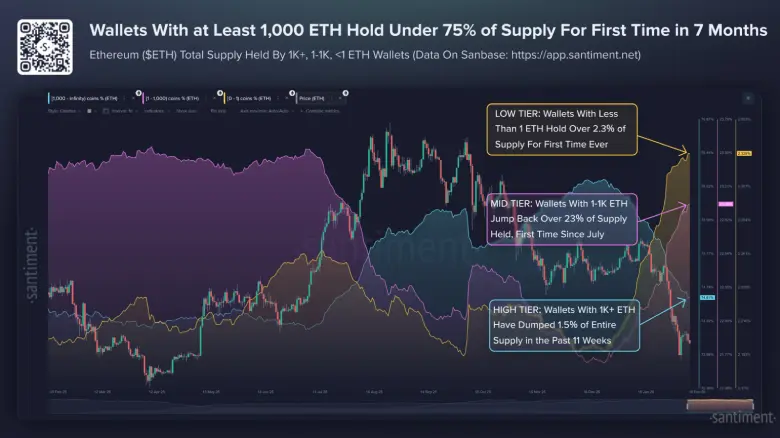

- Ethereum whales now control less than 75% of circulating supply for the first time since mid-2025..

Ethereum, the second largest cryptocurrency by market capitalization, slips 3.73% during Wednesday’s U.S market hours to trade at $1,945. This downtick aligns with broader market pullback as recently released January 2026 US nonfarm payrolls came at 130,000, notably reducing market’s expectation for rate cut in March. In addition, ETH’s whale wallets are showcasing a distribution trend, bolstering a risk of prolonged downtrend in Ethereum price.

ETH Drops Nearly 4% Amid Macro Pressure and Whale Sell-Off

.In the last 24-hours, the overall crypto market is down 1.91% to reach a market cap of $2.29 trillion. Subsequently, the Bitcoin price slips 2.21% to $67,320, while the Ethereum price plunged 3.73%,

This downswing is likely fueled by macro-driven risk aversion as the U.S. Bureau of Labor Statistics (BLS) released the US nonfarm payrolls data at 130,000. This figure far exceeds the expected 70,000 mark indicating the largest monthly gain since April 2025.

In addition, the unemployment rate came in at 4.3% in January, slightly below the market expectation of 4.4%. This hotter-than-expected data signals positive growth in the labor market, which reduces Federal Reserve’s need to cut interest rate in March.

Theoretically, a hawkish stance from FED could limit growth potential of financial market, including cryptocurrencies.

That said, Ethereum’s onchain data shows that the wallet wallets (addresses holding more than 1,000 ETH) have reduced their collective grip over the asset circulating supply, falling below 75% for the first time since mid-2025.

In parallel, accounts with holdings from 1 to 1,000 ETH have increased their collective portion past 23%, a mark last observed in July 2025.

Separately, the tiniest addresses – less than 1 ETH – together control more than 2.3% of the supply. That figure is the highest ever for the group, which could be growing through staking efforts.

Historically, the pattern of supply redistribution from whale to retailers has often resulted with significant correction in coin price and heightened volatility in near future.

Ethereum Price to Extend Correction Below $2,000

Earlier this week, the Ethereum price witnessed a renewed selling pressure at the $2,150 resistance. This overhead supply has pushed the coin price to $1,954, registering a 8% loss in the last 48-hours.

The increasing trading volume backing this decline indicates the strong conviction from sellers to extend current correction. Such lower high formation in price suggests that the market still follows a sell-the-bounce sentiment, which is commonly observed in an established downtrend. The downsloping slope of daily exponential moving averages (20, 50, 100, and 200) further reinforces the selling pressure in ETH.

With sustained selling, the Ethereum price is down 16.8% to reach a multi-year support trendline at $1,620. This ascending trendline stands as the key accumulation zone for crypto buyers as it has previously bolstered the ETH to replenish its bullish momentum for a strong price reversal.

On the contrary, if sellers force a breakdown below the supply, the Ethereum price could enter a major bear cycle.

Also Read: Trust Wallet Names Felix Fan as CEO in Leadership Shift