Large Ethereum holders have recently offloaded massive amounts of ETH, triggering intense selling pressure across the crypto market. Despite Ethereum rebounding by over 13% from recent lows, whale wallets continue booking profits. Market volatility, regulatory announcements, and general market conditions determine investor sentiments in this particular market.

Ethereum Whales Take Profits as Selling Pressure Mounts

The Ethereum price reached $1,400, after which whales executed massive ETH sales worth millions before the market rebounded to $1,612. In 2016, this early investor sold their 10,702 ETH holdings worth $16.86 million, which they purchased when the ETH price was $8 that year. The extensive transaction originated from an idle wallet in 2018 and remains inactive until today.

Investors who remained invested in Ethereum while reaching $4,000 in 2021 are selling their assets to protect themselves from potential price decreases. Whales have altered their investment strategy through profit-taking behavior because they now select a sell-on-rise method. Whales have deliberately changed their behavior in an uncertain retail market where traders expect stability.

Daily trading volume exceeding $35 billion occurs, with a 36% boost in activity since whale investors have sold their assets. Market sentiment remains weak after the brief rally because significant worldwide uncertainties cause longtime investors to dispose of their assets. Market uncertainties persuade lettered investors to stay cautious because near-term price movements generate unfavorable market conditions.

Trump Trade Pause Offers Crypto Brief Relief

President Donald Trump imposed a three-month trade barrier moratorium, bringing short-term comforts to the crypto market from other financial sectors. The market shows an unstable confidence level because investors lack definite market triggers, and active whale sales persist. World Liberty Financial, which is linked to Trump, has executed ETH sales as part of its token market downturn.

The recent market liquidation caused investors to question politicians’ and financiers’ possible participation in these sales. Despite slightly better global macro conditions, Ethereum has experienced limited impact because legacy investors continue selling their ETH holdings. Analysis teams monitor different signs that might signal a market recovery.

The U.S. SEC authorized spot Ethereum ETF options trading, which might attract institutional investors. Enhancing the market depth of ETH through this approval would attract investments from big financial institutions. According to market predictions, combining institutional acquisitions and decreased whale participation would create better liquidity conditions.

Falling Wedge Pattern Suggests Ethereum Rebound

Popular analyst Luciano-BTC identified a falling wedge pattern on Ethereum’s chart, which often signals a bullish reversal. ETH has maintained stability above critical support, building the case for a possible upward breakout. Market participants pay attention to the trendline to verify lasting price movement reversal.

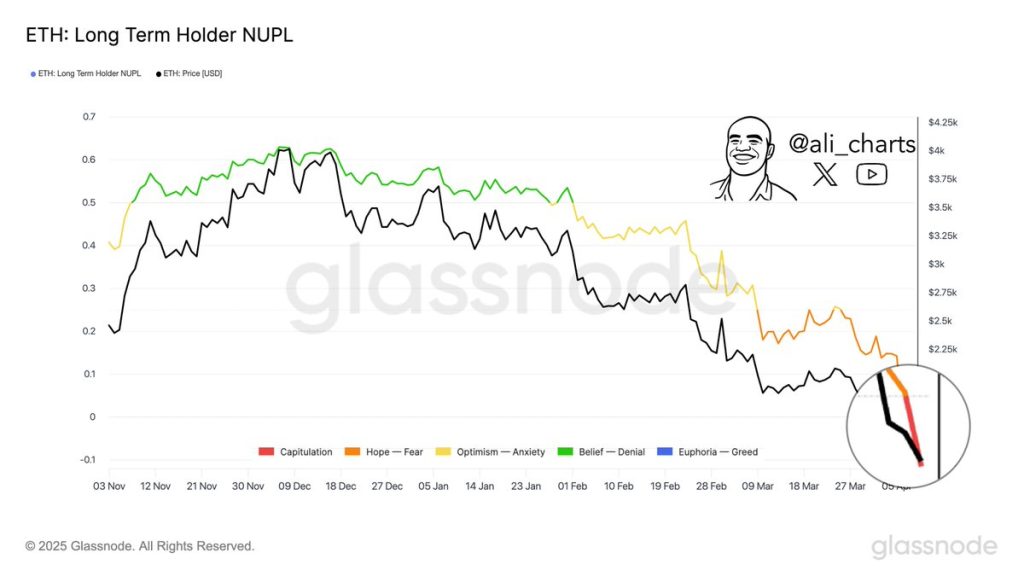

Ali Martinez advocates that contrarian investors should enter the market because of favorable risk-to-reward proportions at this point of market capitulation. If ETH regains momentum and breaks out of the consolidation range, new buyers entering at lower levels could benefit. The increasing number of trades bolsters the prospects that the asset might regain its strength.

Source: Ali Martinez

If ETH breaches key resistance levels, analysts believe a strong rally could follow, led by institutional interest and positive sentiment. Market participants currently show careful optimism because they need more convincing indicators. The subsequent few sessions will be critical for confirming Ethereum’s direction.

Also Read: Ethereum Price Eyes Key Breakout as SEC Greenlights ETH-Based Options Trading