The second-largest cryptocurrency, Ethereum, jumped 3.76% during Monday’s U.S. market hours to trade at $2,315. This upswing followed a notable correction over the weekend, caused by the escalating geopolitical tensions in the Middle East. On-chain analysis further accentuates the key resistance that buyers must reclaim to drive a bullish reversal trend.

Ethereum Gains Steam as Whales Accumulate Over $110M in ETH

Over the weekend, the cryptocurrency market witnessed a major sell-off as the United States joined the conflict in the Middle East by striking the Iranian nuclear sites on Sunday morning. As a result, the Bitcoin price teased a breakdown below the $100,000 psychological support and accelerated correction in the majority of major cryptocurrencies, including ETH.

The Ethereum price also plummeted from $2,572 to $2,115, resulting in a 17.6% loss. However, the coin price bounced sharply on Monday, June 23rd, and reached its current trading price of $2,374

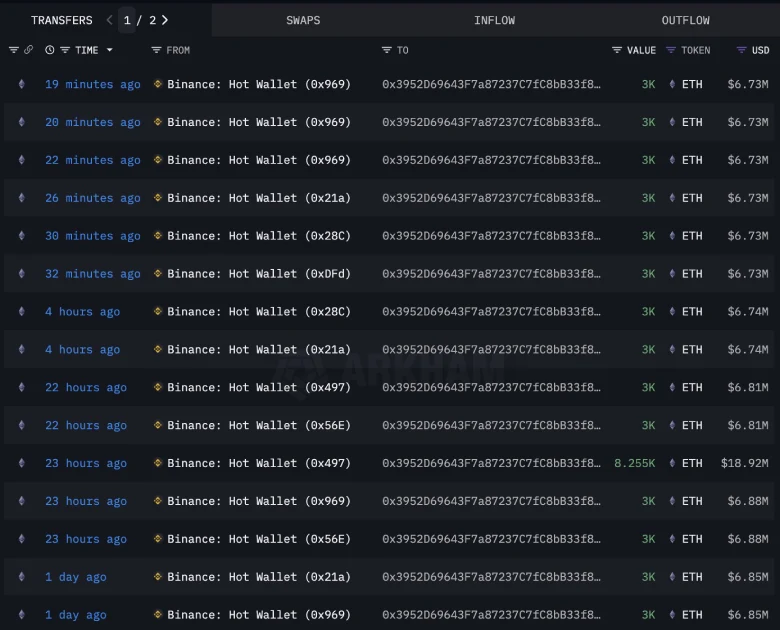

The recent on-chain analysis highlights that the buying pressure was backed by a substantial accumulation by deep-pocket investors. According to the blockchain tracker platform Lookonchain, a mysterious whale created a new wallet, 0x3952, after the recent market drop and withdrew approximately 50,256 ETH, worth around 112.9 million, from the Binance Exchange.

Such accumulation often reflects the investor’s confidence in an asset’s long-term growth as they accumulate the coin during short-term pullbacks triggered by market uncertainty.

Key Resistance to Watch Amid ETH Price Correction

An analysis of Ethereum’s daily timeframe chart shows the recent correction tested the 50% Fibonacci retracement level at $2,111. Theoretically, a pullback to this level is considered healthy for long-term buyers, as it allows them to recuperate from the exhausted bullish momentum.

While the coin price attempts to recover its lost ground with today’s 5.7% gain, the overhead $2,418 level, which coincides with the 200-day exponential moving average, stands as a tough barrier.

According to the analytics platform IntoTheBlock, the price level from $2,525 to $2,280 creates a high supply zone. At an average of $2,418, a total of $10.06 million addresses hold over 72.49 million ETH. As the geopolitical tension persists in the Middle East, the potential price swing to the aforementioned level would allow investors to close their long position at a break-even, potentially creating selling pressure in the market.

Thus, the Ethereum price could revert from the $2,400 resistance with a sell-the-bounce sentiment before re-challenging the $2,110 floor and potentially breaking down below $2,000.

On the contrary, if the contract price breaches the $200 EMA slope, the ETH buyers could gain an initial momentum to renew the recovery trend.