Key Highlights:

- An OG whale has deposited 2,200 ETH worth $10 million to crypto exchange Bybit, which has raised sell-off concerns.

- The whale had accumulated 16,830 ETH at $181.35 and has deposited 8,130 ETH to exchange in 2025, earning $32.89M profit.

- ETH price dipped in the last 24 hours. The price can also fall if selling accelerates.

Ethereum is facing selling pressure today, September 16, 2025, as a long-term holder, commonly referred to as an “OG whale,” moved a significant portion of assets to centralized exchanges, which hints at possible profit-taking. The move, valued at almost $10 million, has raised eyebrows among traders about further downside pressure on the network’s native token.

Whale Activity Raises Eyebrows

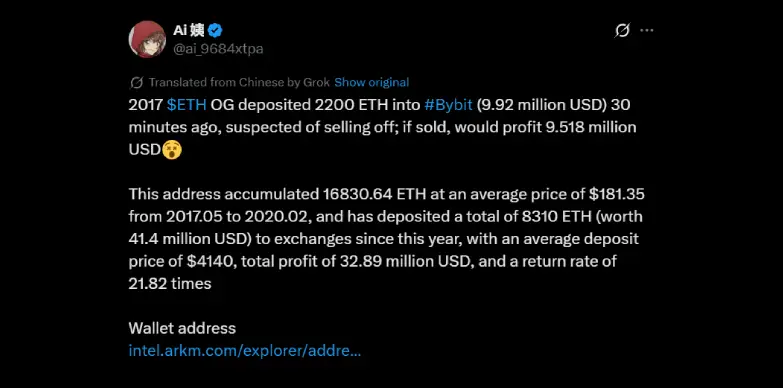

According to on-chain data trackers and a X user ai_9684xtpa, an Ethereum wallet that has been active since 2017 has deposited 2,220 ETH, which are worth almost $9.92 million, into a well-known cryptocurrency exchange, Bybit, today. This sudden transfer is giving rise to speculations that the holder might just be preparing to sell. Moreover, the whale has been depositing tokens on the crypto exchange Bybit for the past two weeks. Two weeks ago the whale had deposited ETH to Bybit which were worth almost $9 million.

What stands out here is that there is a long-term history associated with this address. Between May 2017 and February 2020, the wallet had managed to collect 16,830 ETH at an average acquisition price of $181.35. This accumulation phase coincided with Ethereum’s early growth stage, well before its explosive rally in 2021.

Since the start of this year, the same address has already deposited a total of 8,310 ETH onto various exchanges. At an average deposit price of around $4,140 per ETH, the wallet has realized a total profit of about $32.89 million. The calculated return rate stands at an impressive 21.82 times from its original entry.

Ethereum Price Dips on Sell-Off Signals

Looking at the situation, this latest exchange activity from the whale, Ethereum dipping by 1.1% in the past 24 hours (as per CoinMarketCap), all of this indicates that the token is trading under pressure in the broader market. While ETH has also shown a significant amount of resilience in the recent weeks amid broader crypto inflows, whale activity of this scale usually gives rise to a sense of caution across retail and institutional participants.

Market observers note that such large transfers to centralized exchanges typically indicate an intent to sell or rebalance positions. Given the size of the wallet’s holdings, even partial sell-offs can add downward liquidity pressure or trigger short-term volatility in price moves.

At press time, the ETH price stands at $4,512.14 with a dip of 0.08% in the last 24 hours as per CoinMarketCap.

Ethereum Price Outlook: Risk of Further Declines?

The timing of the deposit is sensitive. Ethereum has been trying to reestablish bullish momentum after the recent macroeconomic uncertainties surrounding U.S. inflation data and Federal Reserve policy signals. Even though the broader digital asset market has managed to stabilize, an influential whale, when it books millions in profit, it has the ability to influence the market sentiment.

Historically, if a whale sells off its tokens, it always has a cascading effect on the price and the market, and there is a rise in short-term volatility. If 2,200 ETH transferred to Bybit is sold immediately, it can increase the selling pressure and test critical support levels.

According to More Crypto Online’s recent X (formerly known as Twitter) post, Ethereum’s price has not changed much since yesterday.

From the post, it is suggested that the price may fall a bit more, but if it manages to climb above $4,675, that would signal that the worst of the drop could be over. As of now, the ETH price is just moving sideways without a clear direction.