On Wednesday, June 4th, the Ethereum price experienced overhead supply at $2,700, resulting in a long wick rejection candle. The selling pressure prevented ETH buyers from breaking out of a major bullish pattern, signaling the continuation of the consolidation trend. However, the latest chain data highlights a major accumulation from whales/institutions via over-the-counter (OTC) transactions, reinforcing a bullish counterattack.

Massive Ethereum OTC Deal Hints at Institutional Accumulation

Over the past three weeks, the Ethereum price has resonated within a narrow range of $2,738 to $2,350. In the daily chart, this consolidation exhibited notable rejection on both sides, indicating no clear dominance from either bulls or bears.

Despite the uncertainty, ETH whales/institutions recorded a major accumulation through OTC deals, signaling their confidence in a potential breakout. According to Lookonchain data, Galaxy Digital OTC wallet withdrew 89,000 ETH (worth approximately $233.5 million) from exchanges on Monday.

Later, a total of 108,278 ETH ($283 million) was transferred to wallet 0x0b26, likely belonging to a whale or institutional player. Currently, this wallet holds a whopping 139,476 ETH coins, equivalent to $365 million.

Typically, such an accumulation trend from buyers drives a bullish market sentiment and bolsters buyers for price reversal

ETH Hints Major Breakout Amid Reversal Pattern Formation

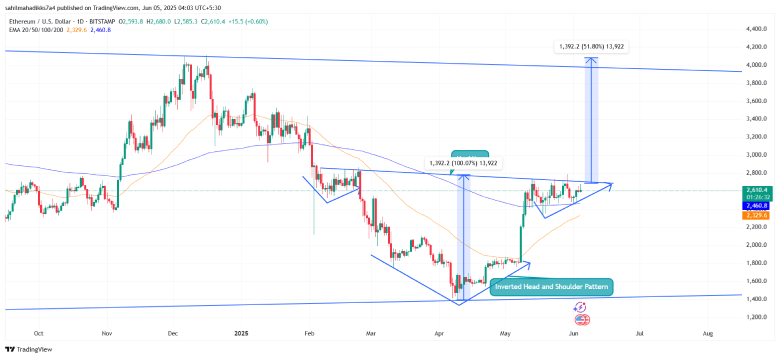

Following a deeper analysis of Ethereum’s technical chart, the current consolidation reveals the formation of an inverted head-and-shoulders pattern. The chart pattern is characterized by three troughs: the middle head and two shallow shoulder dips surrounding it.

Historically, the chart setup is commonly observed at the bottom of a major market trend and drives bullish momentum in the market. The ETH price holding its ground above key daily exponential moving averages (20, 50, 100, and 200) accentuates the broader market sentiment is bullish.

Thus, the altcoin is likely to flip the neckline resistance of $2,700 into a potential support. The post-breakout rally could drive to $3,800 and rest the multi-month resistance trendline.

Alternatively, if the sellers continue to defend the neckline resistance, the Ethereum price could prolong the current consolidation.

Also Read: BTC Rally Incoming? Long-Term Holders Await Ideal Exit Point