Ethereum trading at $1592 is struggling for a bullish comeback. Currently trading with an intraday recovery of 1%, the ETH price is circling to bounce off $1,542.

While the Ethereum price action hints at a potential morning sharp pattern, the multiple bullish failures to surpass the 20-day EMA line keep the bearish flow intact. Amid such crypto market conditions, is a breakout rally possible to the $2,000 psychological mark?

Ethereum Price Analysis Warns of a Steeper Correction?

In the daily chart, the ETH price trend showcases a bullish failure to bounce back within a falling channel pattern. Currently, it is maintaining a sideways shift slightly below the $1,600 mark.

However, since early February, the ETH price trend has failed to regain dominance above the 20-day EMA line. Thus, the declining average line is acting as a dynamic resistance.

However, the short-term sideways shift results in a positive crossover in the MACD and signal lines. This hints at a potential bullish turnaround for ETH.

Furthermore, the current price action in ETH showcases the possibility of a morning star pattern. If the morning star pattern leads to the breakout of the 20-day EMA line, the uptrend in ETH could scale to a new upswing.

Based on the daily chart, the declining 50-day EMA line close to the $2,000 psychological mark seems to be the immediate price target. Furthermore, it ranges close to the overhead resistance trend line.

In case of a channel breakout, the uptrend could scale to the 200-day EMA line close to the $2600 level. On the flip side, a breakdown under $1,500 will prolong the declining trend, potentially retesting the $1,143 support level.

Analyst Spot Key Support Amid Whales’ Offloading

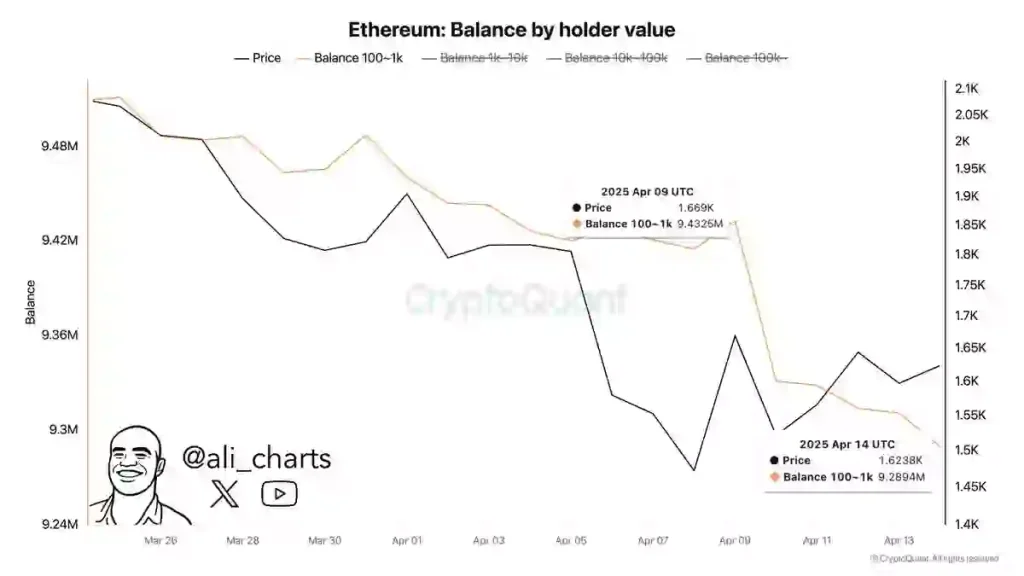

As Ethereum stands at the crossroads, Ali Martinez, a crypto analyst, highlights multiple developments over the past 24 hours. Firstly, the analyst highlights a massive offloading spree by crypto whales in the last week. This is reflected by the crypto whales offloading 143k ETH in the last 7 days.

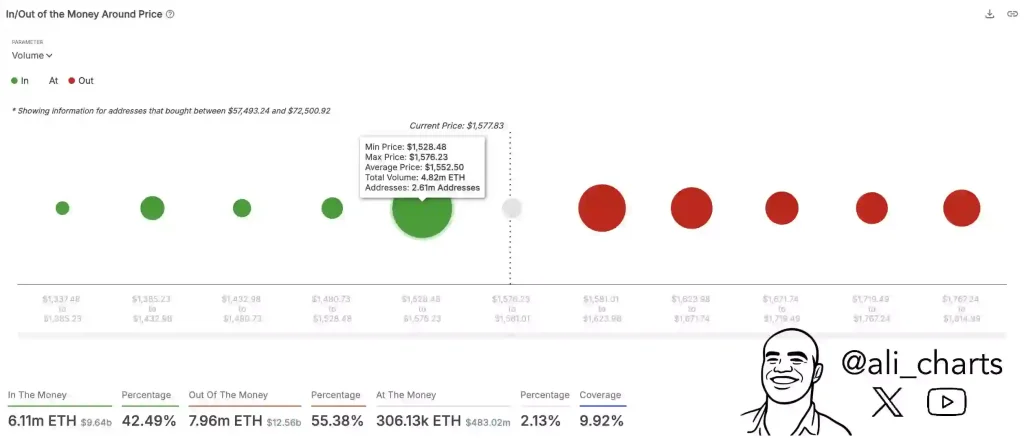

This has plunged the balance by holder value of whales from 9.4325 million to 9.2894 million. Furthermore, the analyst highlights a stronger demand zone for Ethereum, ranging from $1,528 to $1,576. This holds 4.82 million ETH in 2.61 million addresses.

Hence, the short-term offloading spree by the crypto whales is bound to witness a stronger demand zone, potentially absorbing the incoming supply.

Network Slowdown Warns A Slow Death for Ethereum

Santiment, an on-chain data platform, has highlighted a new record low for Ethereum. As per the platform, Ethereum has reached the lowest average network fees in the last five years. This reflects a massive network slowdown for Ethereum due to declining demand.

At present, the cost of a single transaction on the Ethereum blockchain is $0.168. This marks the lowest price since May 2, 2020, when it cost $0.17 for a single transaction.

As the demand declines, the market price of Ethereum is likely to witness a new swing low.