- Record ETF inflows highlight Ethereum’s surging institutional investor confidence.

- Bitmine acquisition of $1.62B supports a bull market in Ethereum in the long term.

- Keeping $4,200 essential; retaking $4,500 will bring back powerful momentum.

Ethereum spot exchange-traded funds recorded their strongest week on record, attracting a massive $2.85 billion in net inflows between August 11 and August 15. This surge set a new all-time high for ETH-focused ETFs, highlighting the growing investor confidence in the asset.

Bitcoin spot ETFs also experienced a surge, although on a lesser scale, with total inflow totaling $548 million. The most successful of them was BlackRock iShares Bitcoin Trust (ABIT), which attracted $888 million of new funds.

From August 11 to August 15 (ET), Ethereum spot ETFs saw a record weekly net inflow of $2.85 billion, marking a new all-time high. Bitcoin spot ETFs recorded a net inflow of $548 million during the same period, with BlackRock’s IBIT leading the pack with $888 million in net… pic.twitter.com/ga6YejSz2l

— Wu Blockchain (@WuBlockchain) August 18, 2025

The record inflows into Ethereum ETFs stand as a pivotal moment for the cryptocurrency market. Investors are keenly assessing how this trend may propel ETH prices up over the near term.

That performance disparity between Ethereum and Bitcoin’s inflows likewise signals a change in investor sentiment, with Ethereum still drawing robust institutional demand.

Analysts contend that the weeks ahead will be pivotal in steering Ethereum’s price trajectory. The convergence of record ETF inflows with optimizing market trends might generate upward momentum, although volatility continues to serve as a pivotal consideration.

Tom Lee’s Bitmine Buys $1.62 Ethereum

Tom Lee, who heads investment firm Bitmine Immersion, has acquired a palpable amount of Ethereum. The company has bought another 373,110 ETH; the entire deal is estimated to be of around $1.62B.

🚨BREAKING:

🇺🇸 TOM LEE’S BITMINE IMMERSION BUYS ANOTHER 373,110 $ETH WORTH $1.62 BILLION. pic.twitter.com/kh1MURdrJy

— CryptoGoos (@crypto_goos) August 18, 2025

This transfer demonstrates the rising institutional attention to ETH, particularly when the market mood seems to get trending more bullish. Such big purchases are usually an indication that the purchaser has a lot of flexibility over the long-term potential of the cryptocurrency.

Will Ethereum Price Reclaim $4,500 Amid Market Uncertainty?

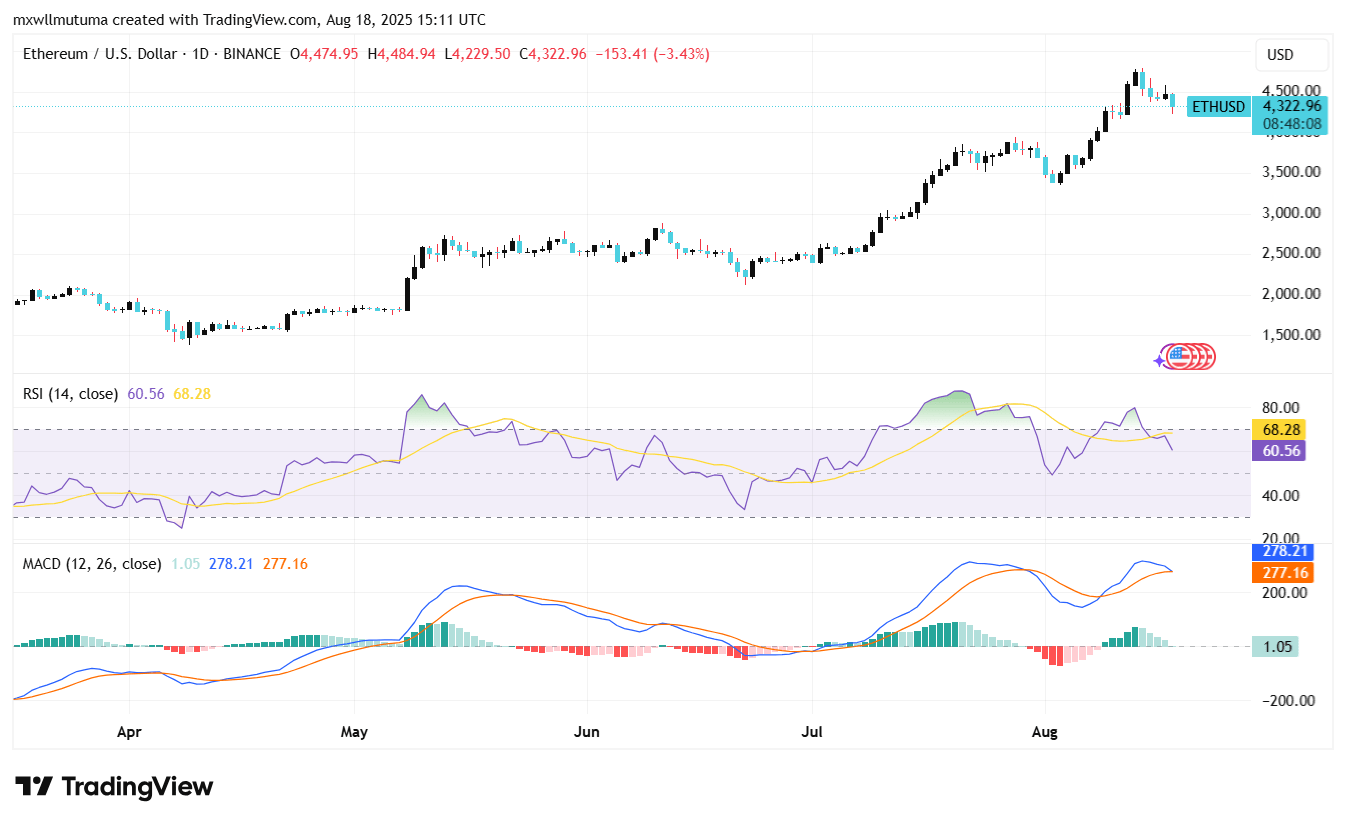

The latest Ether price hovered at $4,315 on Tuesday, showing a decline of 4% in the past session. The cryptocurrency slipped after reaching a daily high of 4,484, while it’s intraday low touched $4,229.

The Relative Strength Index (RSI) is now 60, below the overbought region of 68.26. This indicates that momentum is stalling following an overbought area of Ethereum recently. The reading shows that sellers are getting a part of control following days of bullishness.

The Moving Average Convergence Divergence (MACD) is in bullish territory, the line shows 277.58 against the signal 277. There is, however, a narrow gap indicating a weakening momentum. There is less bullish pressure as well depicted in the histogram, indicating the likelihood of consolidation or correction.

ETH price had been on an uptrend since several months ago, with its price jumping over the $4,500 threshold, a position it had not taken since its recent rally. The present retracement is an indication that traders could be closing their profits, as buyers await new directions to give momentum to higher levels.

The analysts observe that a support above 4,200 may preserve the long-term constructive pattern, although a strong bearish breach would be a potential catalyst to further price weakness. On the other hand, a rebound beyond the $4,500 mark would renew considerable bullish strength.