Key Highlights:

- Ethereum spot ETF records net inflow of $547 million, reversing a five-day outflow streak.

- Fidelity’s spot Ethereum ETF led the buying and acquired 48,850 ETH worth $202.2 million.

- Ethereum’s price increased by 1.9% in the last 24 hours.

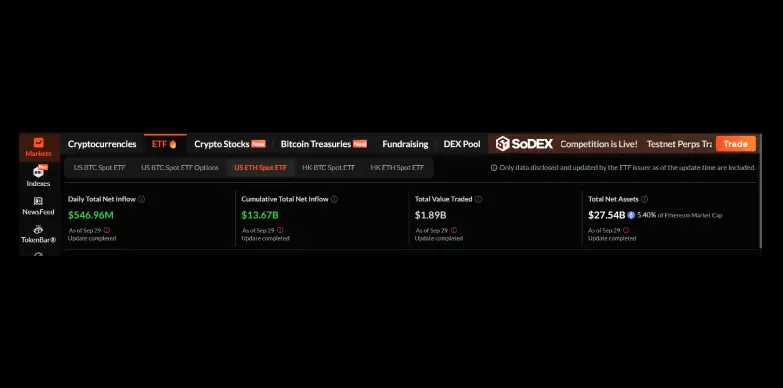

On September 29, 2025, Ethereum spot exchange-traded funds (ETFs) saw a major turnaround with net inflows of $547 million. This large number of inflow ended a five-day streak of withdrawals, which indicates that the investors are regaining confidence in Ethereum’s spot ETFs. Data from SoSoValue indicates that there is a rising interest and growing demand from institutions that want Ethereum exposure through regulated financial products.

Reversal After Consecutive Outflows

For five consecutive days that led up to September 29, Ethereum spot ETFs faced steady net outflows as investors stayed cautious. These outflows were probably a result of market volatility and ongoing regulatory uncertainty that was affecting cryptocurrencies such as ETH. The inflow of $547 million on September 29 shows a change in mood, with investors moving back to spot ETFs as a favoured way to gain exposure to Ethereum.

Since the inflow is not small, it is clear that both institutional and retail investors may be preparing for expected positive changes in Ethereum’s ecosystem or for a wider market rebound. It can also be deduced that the selling that was seen in the previous days was more about short-term profit-taking or quick reactions, rather than lasting withdrawals.

Current Snapshot of Ethereum Spot ETF Assets

Following the strong inflow on September 29, the total net asset value (NAV) of Ethereum spot ETFs now stands at approximately $27.54 billion. This number also represents a significant amount of capital that is locked in regulated Ethereum investment products. Since the number is huge, it indicates a growing appetite for Ethereum’s digital asset exposure in the compliant structure.

One measure that shows the importance of the Ethereum spot ETF is the ETF’s net asset ratio. This ratio compares the total market value of all Ethereum ETFs to Ethereum’s entire market capitalization. At 5.4%, it shows that ETFs now make up a meaningful share of Ethereum investments.

Since the launch of this product, ETF products have managed to attract a total net inflow of $13.67 billion. This steady growth highlights strong and lasting demand, as well as growing trust from investors in regulated products that let them track Ethereum’s price directly, without dealing with the risks or complexity of trading on crypto exchanges.

Fidelity’s Spot Ethereum ETF Leads Significant Buying

A big part of Monday’s inflow came from Fidelity’s spot Ethereum ETF, which bought 48,850 ETH worth $202.2 million on September 29, according to market reports. This buying also indicates confidence from one of the world’s largest asset managers in Ethereum’s future and in the role of spot ETFs as trusted investment tools.

Fidelity’s move may be driven by a positive outlook on upcoming Ethereum network upgrades that are looking to improve scalability and lower transaction costs. On top of that, clearer regulations in major markets like the United States are expected to bring in more inflows into spot ETFs as compliance risks become smaller.

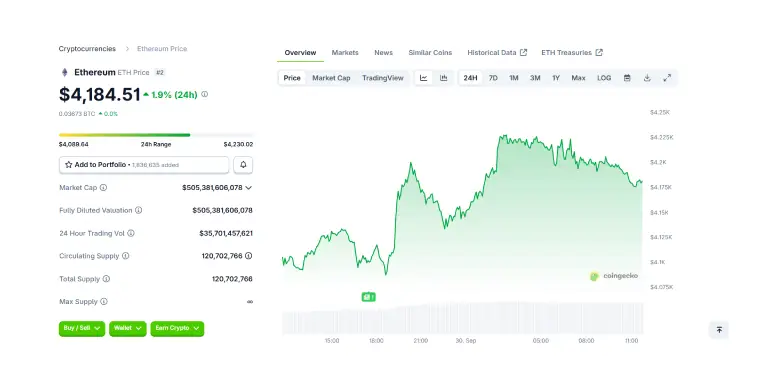

Alongside the strong ETF inflows, the market capitalization of the cryptocurrency market went up by 1.5% and crossed the $ 4 trillion mark. The price of the ETH token also experienced an uptick. At press time, the price of ETH stands at $4,184.51 with an uptick of 1.9% in the last 24 hours as per CoinGecko.

Improving Market Sentiment

The crypto market’s fear and greed index has also moved up to 50, which indicates a neutral to moderately optimistic outlook among investors. This is a positive sign for continued inflows and steadier prices in Ethereum and related products.

Also Read: Cardano Price Eyes $1 Ahead of October ETF Decision