Key Highlights:

- Ethereum (ETH) falls below the $4,000 mark today, September 25, 2025.

- As of September 24, 2025, Ethereum spot ETF saw $79.4 million in outflows.

- More than $100 million worth of ETH long liquidated within an hour today.

Ethereum (ETH) dropped sharply below $4,000 today on September 25, 2025. This is the first time the token has fallen under this level in more than 40 days. The decline followed heavy exchange-trade fund (ETF) outflows and the liquidation of ETH long positions, unsettling investors and shaking market confidence.

At press time, the price of the token stands at $3,997.25 with a dip of 3.54% in the last 24 hours as per CoinMarketCap.

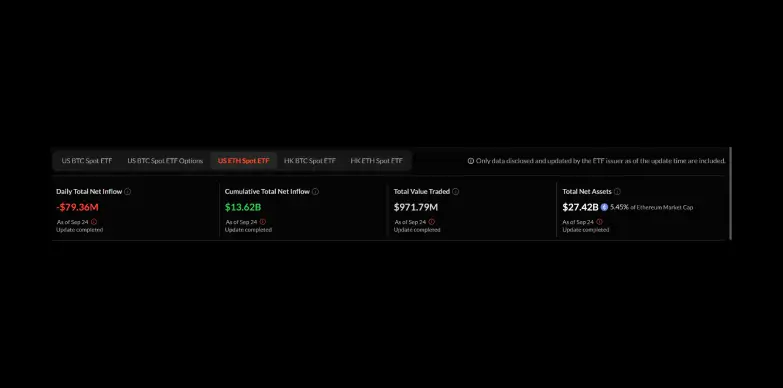

Ethereum (ETH) had been leading the altcoin market a few weeks back. This momentum was boosted by strong rollout of ETH ETF products on global exchanges. U.S. Spot ETH ETFs increased from about $10.32 billion in June to $27.48 billion in September. These inflows reduce the amount of ETH available on exchange and decrease the supply of the token which then supports upward price pressure. However, the strong pullback that ETH is experiencing right now is pointing to a clear reversal in its upward trend.

ETF Flows Highlight Stark Divergence

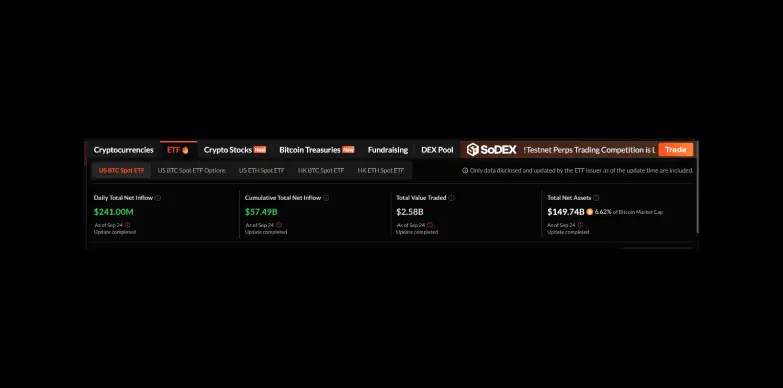

As per SosoValue data (September 24, 2025), it was revealed that there is strong divergence in investor behaviour between Bitcoin and Ethereum ETFs.

Bitcoin ETFs indicated a solid demand. It recorded $241 million in inflows, which is about 2,150 BTC moving into institutional hands.

However, Ethereum ETFs saw a significant volume of outflow. According to the Soso Value data, Ethereum saw $79.4 million in outflows which is equal to 19,080 ETH being sold off. This sharp imbalance indicates a drop in institutional interest in ETH.

The split between Bitcoin’s strength and Ethereum’s weakness has added to overall volatility. Bitcoin’s rally here is being supported by steady ETF inflows, while Ethereum’s outflows have create a liquidity squeeze and it has given rise to a sense of fear amongst the investors.

It is clear that the investors are losing interest in the token. At the same time, funding rates in ETH futures have also flipped negative which indicates that traders are turning bearish.

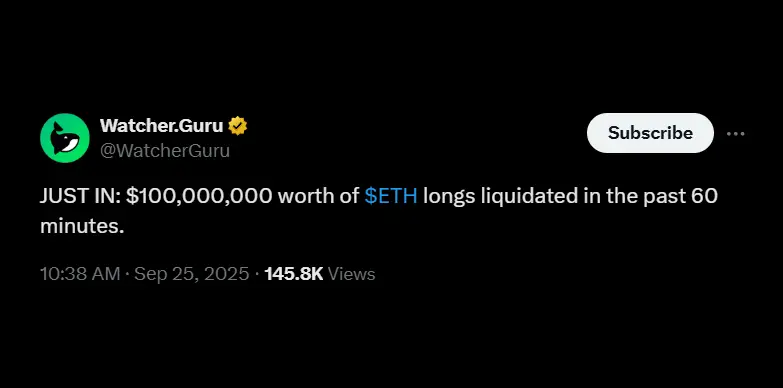

The $100 Million Liquidation Wave

According to Watcher Guru, within the last sixty minutes, more than $100 million worth of ETH long positions were wiped out on derivative exchanges. Many traders betting on Ethereum with high leverage had their positions forcibly closed as the price of the token fell. The use of high leverage made losses even worse and the margin calls triggered more selling, speeding up the drop.

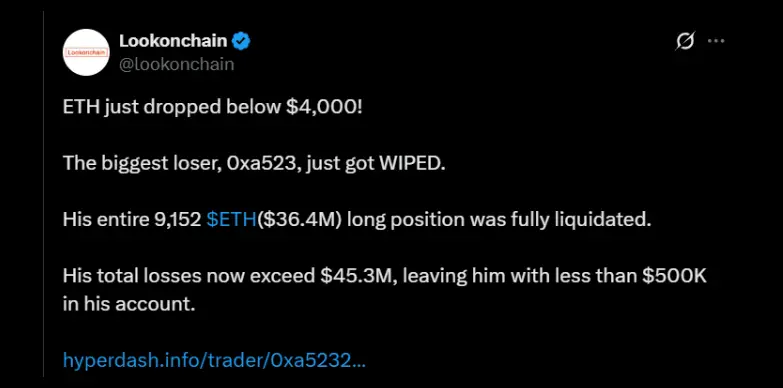

Whale Wipe Outs and Market Psychology

On-chain data also revealed a separate whale-level wipe out, with address 0xa52 lost $36.4 million, which is almost 9,152 ETH long, leaving under $0.5 million and total losses over $45.3 million. Events like this are not rare, the day saw $104 million in total ETH liquidations, showing that even big traders are under pressure and highlighting the market’s fragile state.

Can ETH Recover?

According to Michael van de Poope, CIO & Founder of MN Fund, Ethereum is nearing its local bottom, with most of the downside already played out. He highlighted a “crucial area to hold” in the green zone on the chart, which aligns with support in $3,750-$3,800 range.

Michael indicates that while ETH may drop by 5% more, this green support zone is where he expects a reversal or stabilization. These views imply that most forced liquidations may be behind us soon and further downside should limited if this key support holds up.

Also Read: Dogecoin Price Holds Key Support as Whales Scoop Up 2 Billion DOGE