- Ethereum price witnessed increasing demand pressure at the bottom trendline of an expanding channel pattern.

- Santiment data Both short-term and long-term MVRV ratios have fallen below neutral levels, historically a strong buying opportunity.

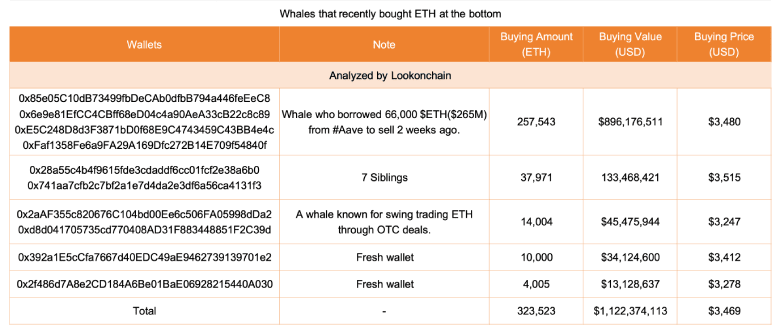

- Blockchain data from Lookonchain shows a renewed accumulation trend from crypto whales amid the recent market correction.

Ethereum, the second-largest cryptocurrency by market capitalization, jumped over 4% on Wednesday. Market hours to trade at $3,490. The buying followed a broader market relief rally as Bitcoin stabilized above the $10,000 support. However, the Ethereum price gained additional momentum as on-chain data, renewed whale buying, and technical support signal a potential rebound. Will ETH rebound above the $3,500 mark?

ETH Faces Heavy Liquidations, ETF Outflows And Strong Dollar Pressure

By press time, the Ethereum price is up 4.2% to trade at $3,400. Following a sharp increase in Ethereum price earlier this week, this buying pressure signaled a relief rally in the crypto market as Bitcoin projected sustainability above $100,000.

According to Santiment analysis, the upswing comes at an interesting time of market stress, with short-term traders still facing significant losses. The average return over the last 30 days for active traders is -12.8%, which shows a continuation of the negative sentiment and underperformance that has persisted after recent volatility.

Comparing the average return to the 365-day moving average, wallets active over the last year have also turned to the red side, giving a 365-day moving average of -0.3%. Historically, this dual decline in MVRV, both over short and long-term time frames, has occurred over accumulation periods when lower average entry prices tend to attract strategic buyers of discounted exposure.

On-chain activity has contributed to that trend. According to Lookonchain, during the recent correction, the large holders of Ethereum have been buying aggressively. Blockchain monitoring indicates that several whale addresses are jointly buying around 323,523 ETH, which is estimated at $1.12 billion, within a span of just two days.

One of the biggest buyers was traced to a whale that had borrowed 66,000 ETH from Aave to sell about two weeks ago but has since re-entered the market with a purchase of 257,543 ETH at an average of $3,480 per token.

Another set of wallets named 7 Siblings together added 37,971 ETH, which is approximately $3,515 each. Other transactions were from known over-the-counter traders and newly created wallets, which purchased between 4,000 and 14,000 ETH at prices between $3,247 and $3,412.

Large-scale reaccumulation implies renewed positioning among key holders, as Ethereum climbs back above a key short-term inflection point following its latest trough.

Ethereum Price Holds Key Support Within the Channel Pattern

Over the past week, the Ethereum price has shown a notable correction from $4253 to a low of $3157, registering a 28% loss. The falling price currently seeks support at the bottom trendline of the expanding channel pattern in the daily chart.

Since late August 2025, the coin price has been actively resonating within the two downsloping trendlines of this pattern. The diverging nature of this trendline creates larger price swings each cycle, indicating the increasing market uncertainty.

If the ETH price manages to hold this support and breach the immediate resistance of $3,665, the buyer could re-strengthen their grip over this asset for a stronger recovery.

On the contrary, if the price breaks below the bottom trendline around the $3000 psychological level, the market’s bearish momentum would accelerate and drive a prolonged downtrend towards $2,388.

Also Read: Arthur Hayes: US Government Restart Could Ignite Bitcoin and Zcash Rally