The Ethereum price plunged 0.6% during the U.S. market hours to currently trade at $3,768. The intraday selling pressure aligns with the general market pullback as the Federal Reserve leaves interest rates unchanged at 4.25% – 4.50%. While the mounting bearish momentum hints at a prolonged correction ahead, the on-chain data highlights renewed interest from crypto whales, as they buy ETH in this dip.

ETH Whales Buy the Dip Again

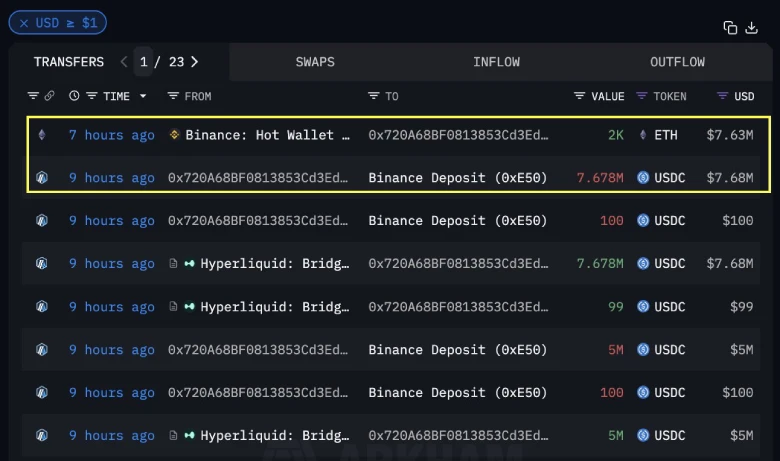

In the last three days, the Ethereum price plunged from $3,942 to the current trading price of $3,750, accounting for a 4.8% loss. Despite the bearish reversal, the on-chain data highlights a renewed accumulation trend from high-net-worth investors. According to the blockchain tracker SpotOnChain, a crypto whale wallet “0x720” locked in its $6 million Ethereum long position just yesterday.

However, the activity didn’t end there. Within the nice hours of reporting, the same whale withdrew $12.65 million from the HyperLiquid trading platform and sent it to the Binance Exchange. The funds were used to acquire 2,000 Ethereum at $3,839, spending roughly $7.68 million.

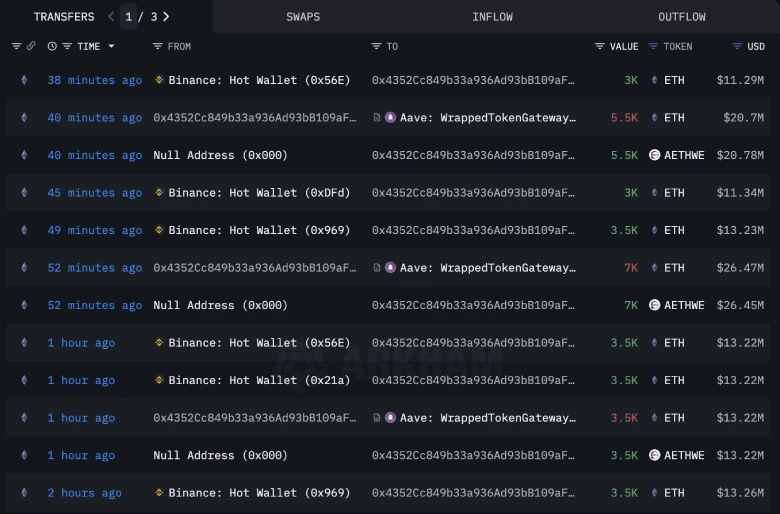

Additionally, another whale, “0x4352,” withdrew 20,000 ETH (worth approximately $75.56 million) from Binance early today, according to Lookonchain data.

While the current slowdown in recovery momentum may concern retail investors, the smart money continues to buy more ETH, signaling their confidence in the asset’s long-term prospects.

Flag Pattern Set Ethereum Price For Short Pullback

In the daily chart, the Ethereum price displays the recent pullback with three red candles having short bodies and long rejection on either side. The structure may indicate a lack of conviction from buyers to sellers to give the price a sustained direction.

However, the four-hour chart analysis shows the current price pullback resonates between two downsloping trendlines of a bullish continuation pattern called a ‘flag.’ The two trendlines, as dynamic resistance and support, show a declining channel that may allow buyers to replenish the exhausted bullish momentum.

Currently trading at $3,760, the ETH price is less than 1% away from challenging the pattern’s overhead resistance. A bullish breakout from this resistance will signal the continuation of the prevailing recovery and bolster buyers to chase a bullish breakout from the $4,100 mark.

However, if the sellers push a breakdown with the pattern’s lower trendline, the correction trend could gain momentum and drive a prolonged downfall towards $3,500.