- Ethereum price offers a decisive breakout from the flag pattern.

- According to the ETH validation queue, over 2.5 million ETH wait at the exit line and 1.38 million ETH stand at the entry line.

- ETH’s fear and greed at 46% accentuates a neutral sentiment among crypto investors.

ETH, the native cryptocurrency of the Ethereum network, records a 1.76% surge during Wednesday’s U.S.market session. The buying pressure likely followed a broader crypto market uptick as recession fears continue to push investors to alternative assets like gold and Bitcoin. However, the notable volatility in Ethereum’s price could also be attributed to the substantial staking deposits and withdrawals, teasing the supply dynamic.

ETH Validator Exits and Institutional Staking Drive Liquidity Shifts

Over 2.44 million ETH, worth approximately $10 billion, is in the Ethereum validator exit, suggesting one of the longest withdrawal queues to date since the network was switched to proof-of-stake. On-chain data show that the congestion has increased the average wait time for withdrawals to approximately 42 days, as the validators attempt to withdraw their stakes.

In the current system of Ethereum, validators that decide to quit have to enter an exit queue,, and their money is released progressively to prevent disrupting the security of the network. The sudden increase in withdrawals has led to the debate of possible liquidity changes in the market in case a portion of the numbered ETH gets to exchanges. Since a major release of such quantity is coordinated, observers point out that it would potentially affect the short-term movement of trading on the large crypto platforms.

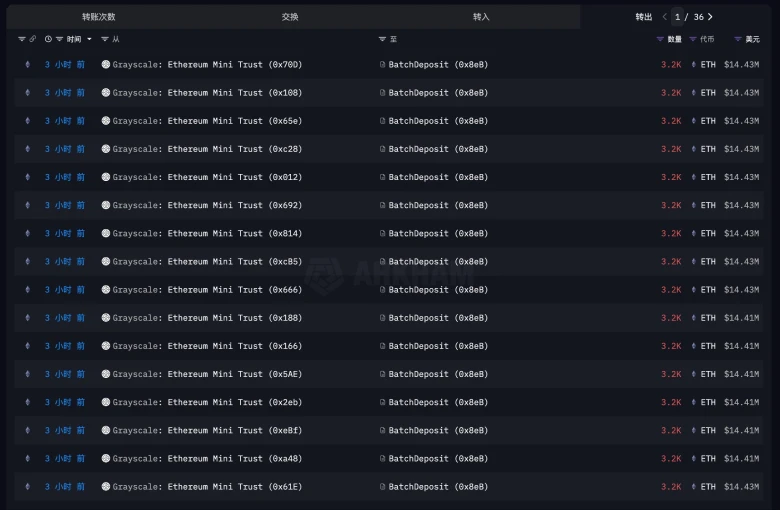

Meanwhile, stakeholder activity is growing in other places. According to EmberCN, the two Ethereum spot ETFs of Grayscale have recently deposited a significant number of ETH to staking pools. The funds allegedly staked 857,600 ETH, which is estimated to be worth approximately $3.88 billion, in the last several hours, according to them, and their total staked holdings are approximately 1.16 million ETH, or approximately $5.25 billion.

New staking reserves are also increasing at a very high rate. The number of validators waiting to be activated is currently more than 1.38 million ETH, of which Grayscale allocations are almost 84% of that sum.

Although the $10 billion withdrawal line indicates increased caution in some validators, the offensive build-up by institutions such as Grayscale implies a new wave of confidence among institutional investors. Ethereum is entering a stage of increased liquidity flows, as outflows and inflows rise, potentially impacting the short-term volatility of ETH over the coming weeks.

Ethereum Price Hints Make-or-break Scenario

In the last two weeks, the Ethereum price has shown a sharp recovery from $3,822 to $4,758, accounting for 24.5% growth. Amid this rally, the coin price offered a decisive breakout from the resistance trendline of a bullish continuation pattern called FLAG.

The chart setup is characterized by an ascending trendline reflecting the dominant trend in price, followed by a temporary pullback within a downsloping channel. While the recent breakout was expected to accelerate buying force, the crypto market sell-off on Tuesday opened a counter possibility in technical analysis.

If the bearish momentum persists, the Ethereum price could give a breakdown below Tuesday’s candle low of $4,428, with the daily candle closing. The post breakdown fall could spark another correction in ETH, and push the price another 8.2% before hitting the immediate resistance of $4,000.

On the contrary, if the Ethereum price manages to regain its position above $4,600, the buyers could regroup and complete the flag pattern for a $5,400 target.