The crypto market turned bearish in the first few days of April as U.S. President Donald Trump announced new tariffs on imports from various countries. The selling pressure plunged pioneer cryptocurrencies Bitcoin and Ethereum below major support, signaling the resumption of the correction trend. However, on-chain data shows no fear among large-scale investors as they continue to accumulate more ETH in this dip.

Key Highlights:

- A fresh lower high formation in ETH’s daily chart indicates the overhead selling is intact.

- The 20-day exponential moving average drives a high-momentum downtrend in Ethereum price.

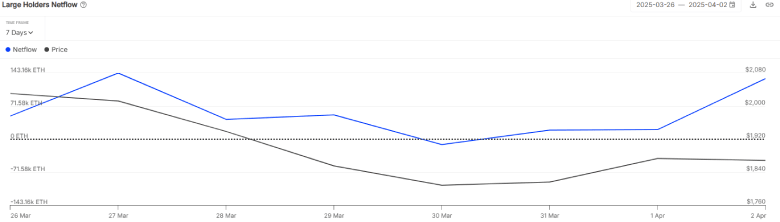

- Large-scale investors continue to buy the dip, with over 130,000 ETH yesterday, reflecting confidence in long-term prospects.

Ethereum Whale Activity Signals Bullish Counterattack

Affected by the tariff war, the Ethereum price plunged to $1,750 before the U.S. trading session, which is its lowest level since October 2023. While the market trend signals the continuation of further downfall, the chain data highlights accumulation from smart-money investors.

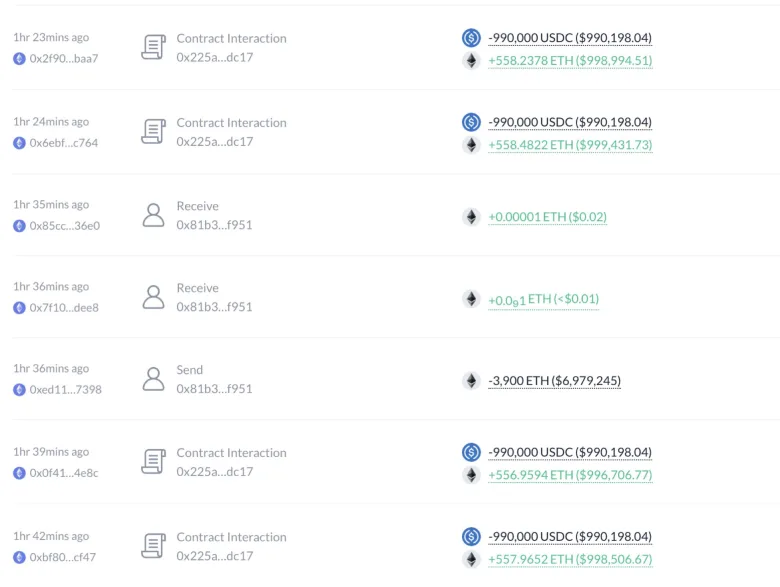

According to blockchain tracker Lookonchain, a crypto whale spent 11.5M USDC to purchase 6,488.5 ETH at an average price of $1,772.

In a similar vein, Intotheblock data shows Ethereum whales have been actively “buying the dip,” with the largest ETH wallets adding over 130,000 ETH to their holdings just yesterday. This accumulation trendline indicates growing confidence among institutional players in Ethereum’s long-term prospects despite short-term price fluctuations.

Bear Traps Sets Ethereum Price Surge Past $2,000

An analysis of ETH’s daily chart shows a V-top reversal from $2,103 to the current trading value of $1,786, registering a 16.8% drop. The falling Ethereum price breaks below a multi-year support trendline, accelerating the bearish momentum in this asset.

However, the coin price shows a lack of follow-up on this breakdown, signaling a weak conviction from market sellers. As the price movement shows increasing demand pressure at $1,750 support, the buyers could counterattack and reclaim the breached support trendline.

A potential upswing will mark the previous breakdown as a bear trap and drive a recovery above the 20-day EMA and $2,000. A bullish breakout from these initial barriers is crucial to drive a sustainable recovery.

On the other hand, if the sellers continue to defend the 20-day EMA slope, the current correction could be prolonged in April’s second half.

Also Read: Will Solana Price Lose the $112 Yearly Support Amid Whale Selling?