- The Ethereum price correction is 2% away from challenging a long-coming support trendline of head and shoulder pattern.

- Core inflation slowed to 2.6% year over year, marking the sharpest cooling in nine months

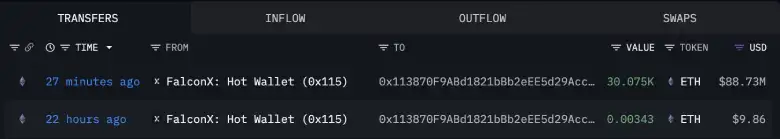

- On-chain data shows Tom Lee’s BitMine Immersion Technologies bought around 30,000 ETH for approximately $89 million, through FalconX.

ETH, the native cryptocurrency of Ethereum ecosystem plunged 0.7% during Thursday market hours to reach $2,814 trading value. The pullback followed market wide correction despite a favouring US Consumer price index (CPI) data of 2.7%. The falling Ethereum price is continuing with the formation of a bearish reversal pattern called head and shoulder, signaling a risk prolonged correction below the $2,800 mark.

ETH to Test Key Support on Inflation Relief and Institutional Buying

Earlier today, the Ethereum price jumped nearly 5.75% to mark an intraday high of $2,995. The upswing followed the Bureau of Labor Statistics reporting the U.S. inflation figures for November on December 18, 2025, of 2.7% annual rate of inflation, below the 3.1% that was projected.

The core figure (excluding food and energy) rose 2.6% year over year, against expectations of 3.0%. This was the biggest easing in inflationary pressures in nine months, though due to data collection delays from a previous government shutdown, some analysts take the readings with a pinch of salt.

The subdued figures reduced apprehensions about the possibility of further Federal Reserve tightening. Market-implied probabilities of a 25 basis point rate cut at the January 2026 meeting have increased to about 26-27%, in line with patterns in which the downside to a tighter-than-expected monetary policy has been a boost to higher-risk assets, via increased market liquidity.

Adding upward momentum to Ethereum was on-chain activity tracked by Lookonchain of a wallet associated with Tom Lee’s BitMine Immersion Technologies purchasing some 30,000 ETH, worth close to $89 million, through FalconX, per Arkham Intelligence verification.

This transaction added to the ongoing accumulation of BitMine, which previously announced the addition of $320 million worth of tokens in a previous week which brings their total holdings to near-4 million tokens, or more than 3 percent of Ethereum’s circulating supply.

Selling later in the session was more severe over the digital assets, with Ethereum down 0.7%. Coinglass data showed that forced closures impacted 161,514 positions with combined liquidations across the cryptocurrency industry at $548.31 million.

Ethereum Price Inches Away From Major Support Test

Over the past week, the Ethereum price has plunged from $3,449 to current trading value of $2,830, accounting for a 18% loss. The downswing creating a fresh lower high formation is ETH’s daily chart to indicate a continued sell-the-bounce sentiment in the market.

A broader analysis of daily analysis shows this pullback as part of a well-known reversal pattern called Head and Shoulders. The chart set-up consists of three peaks i.e., a left shoulder, a long head and currently formation of right shoulder. If the pattern holds true, the Ethereum price could plunge just 2% and challenge the pattern’s key neckline at $2.76.

A bearish breakdown below this floor will accelerate the selling pressure on ETH. The post-breakdown fall could push the price another over 20% to seek support at $2,100 mark. An uptick in Average directional index (ADX) at 28% accentuates that sellers have sufficient room to drive prolonged correction.

On the contrary note, if the ETH price shows sustainability above the bottom trendline, the coin buyers could recoup bullish momentum and drive an upswing $3,422.