- The Ethereum price correction could seek bullish support from the long-awaited support trendline daily chart.

- Institutional investors such as Longling Capital and BitMine are steadily increasing their Ethereum holdings amid market pullback.

- The ETH price holding above 23.6% indicates a healthy correction for buyers to recuperate the bullish momentum in an established uptrend.

Ethereum, the second-largest cryptocurrency by market capitalization, is decoupling from the ongoing relief rally in the crypto market. While a majority of major altcoins follow Bitcoin with a bullish upswing, the Ethereum price shows a long-wick rejection candle with a 0.25% intraday loss. While this uncertainty may create concern in retailers, the large investors and institutions are showing their interest by accumulating more ETH. Will the coin resume recovery for a new high in September, or must the market brace for another correction?

Institutional Investors Expand Ethereum Holdings During Consolidation

The Ethereum price correction has shifted its trajectory to sideways, holding above the $4,260 support. In the last two weeks, the coin price has resonated within a narrow range of $4,520 and $4,260, characterized by a series of neutral candles and long rejections.

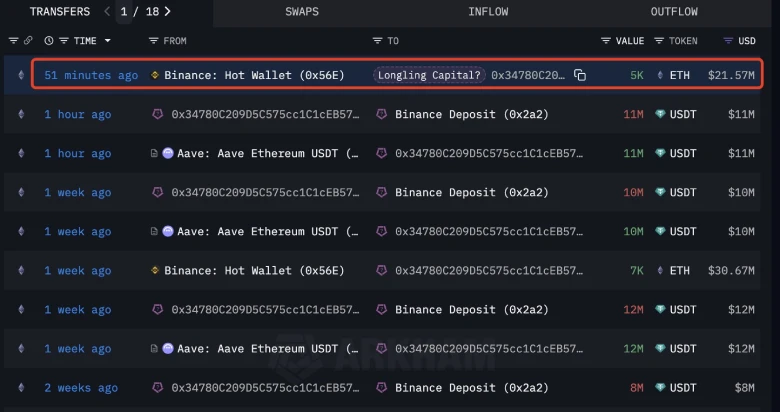

While the sideways action reflects uncertainty among retail traders, the recent on-chain activity highlights a strong conviction from institutions and whales. Longling Capital, a Chinese venture capital firm commonly known as a crypto whale due to its large and strategic trading, has added another Ethereum purchase.

The company purchased 5,000 ETH at an approximate price of $21.57 million, which brought its total assets to 88,589 ETH with an estimated value of $383 million. The action follows a prior build of 7,000 ETH ($30.67 million) on August 31, which underscores its regular strategy of acquiring in market downturns.

The most recent move by Longling is in light of what other substantial players are doing to expand their Ethereum exposure. The crypto mining company BitMine Immersion Technologies, Inc. recorded one of the biggest acquisitions in recent weeks, incorporating 202,469 $ETH, worth $881 million. That sale increased its overall balance to 2,069,443 worth of ETH, approximately 9 billion today.

The disciplined buildup of Longling and the colossal size of the Bitmine position each reflect the process in which whales are solidifying their hold as the wider market passes through periods of consolidation.

Ethereum Price Holds Key Support To Kickstart Renewed Recovery

After hitting a new high of $4,955 on 24th August, the Ethereum price entered a brief correction of 13.25% to currently trade at $4,298. The pullback followed a broader market correction amid the increasing uncertainty of the September rate cut from the Federal Reserve and renewed tariff tension in the broader market.

However, the ETH price correction seeks support from an ascending trendline at $4,100, positioned above the 23.6% Fibonacci retracement level. Since late June 2025, the dynamic support has acted as a key pivot level for buyers to recoup the exhausted bullish momentum.

Additionally, a retest of this FIB level and the following retracement levels of 38.6% and 50% are considered healthy in an established uptrend. Adding to the bullish note, the inclined nature of the daily exponential moving averages of 50, 100, and 200 reflects the broader market sentiment as bullish.

Thus, a potential reversal from the ascending trendline could push the coin price against the overhead resistance of $4,520. A bullish breakout from this resistance could signal renewed recovery and a potential surge to $5,000.

On the contrary, a breakdown below the support trendline could surge selling pressure and drive a prolonged correction.

Also Read: Grayscale Files With SEC to Launch First Spot Chainlink ETF