ETH, the native cryptocurrency of the smart contract giant Ethereum, submitted to market volatility on Monday as it reverted from a 7-month high of $3,940. The pullback from the overbought region signals the potential formation of a bearish reversal pattern and a looming breakdown. However, the recent on-chain data highlights a major accumulation from ETH buyers, signaling an opportunity for a counterattack.

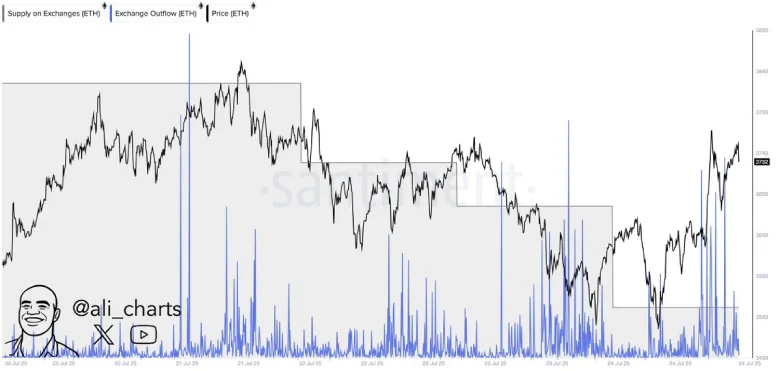

$1.15 Billion Worth of ETH Exits Exchanges in 72 Hours

During the Asian market hours on July 28, the Ethereum price tried to build on the bullish momentum from last weekend to hit a 7-month high of $3,940. The bullish upswing was backed by a substantial accumulation by crypto investors, signaling a sustained demand in the market.

According to a recent tweet from market analyst Ali Martinez, over 310,000 Ethereum (valued at approximately $1.15 billion) has been withdrawn from crypto exchanges in the last 72 hours.

This rapid outflow of ETH suggests increased investor confidence and holding sentiment despite an already recorded rally in ETH.

Historically, such large-scale withdrawals from exchanges have often preceded bullish price momentum, indicating that the Ether price could hold its nearby supports.

Ethereum Price Faces Major Correction Amid Double Top Pattern

With an intraday sell-off of 2%, the Ethereum price drops below the horizontal resistance of $3,860, with a long wick rejection indicating heavy supply pressure. This pullback invalidates the recent breakout of the aforementioned resistance and reveals the potential formation of a double-top pattern.

This chart setup displaying an M-shape is commonly spotted at major market tops, accentuating the pressure of accelerating supply pressure. The momentum indicator RSI is in the overbought region above 70%, with a bearish divergence, indicating the need for a price pullback.

If the selling pressure persists, the ETH price could plunge another 7.6% and challenge the neckline support of $3,500. A potential breakdown below this level would accelerate the selling pressure and drive a prolonged direction toward $3,200.

However, the market participants must keep a close watch on the $3500 floor. An aforementioned accumulation trend could bolster buyers to hold this support and regain the bullish momentum.