- The Ethereum price is poised for a bullish breakout from a tight consolidation range between the $4,520 and $4,258 horizontal levels.

- On-chain data highlights a substantial accumulation of ETH from whale wallets and investment firms, such as Trend Research.

- The Ethereum Fear and Greed Index at 52% reflects a neutral sentiment among market participants.

Ethereum, the second-largest cryptocurrency by market capitalization, jumped over 2.5% during Thursday’s U.S. trading hours to reach $4,458. Along with the general bullish sentiment in the market, the buying pressure on the Ethereum price is fueled by a renewed accumulation trend in large investors. The price jump is nearing a bullish breakout from a week-long consolidation, signaling an opportunity to renew the prevailing uptrend. Is a rally to $5,000 close?

Fresh Whale Activity Signals Renewed Interest in ETH

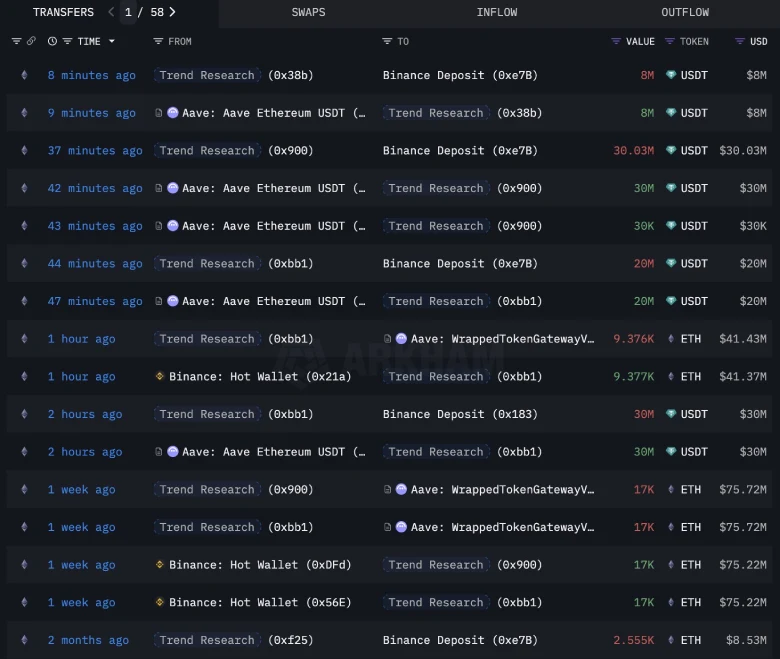

Ethereum markets experienced heightened whale activity in the last 24 hours, with some huge players moving on both centralized exchanges and lending platforms.

Blockchain tracking service Lookonchain flagged the activity from Trend Research, an address that had exited a major position earlier this summer. At the time, the entity offloaded around 79,470 ETH, which was worth around $250 million at an average value of around $3,145.

Recent on-chain flows indicate that the same group is now re-entering the market at higher prices. Earlier today, the wallet withdrew $88 million in Tether from Aave and transferred the money to Binance before going on to withdraw 9,377 ETH, valued at about $41.3 million.

Separate data provided by Arkham points to further accumulation from new wallets. Three newly created addresses have received a total of $205.48 million in Ethereum. The purchases were made through an institutional trading desk called FalconX, which signals that capital from larger market participants is being moved directly into ETH.

Altogether, the two sets of transactions point towards renewed interest in Ethereum from entities that have access to significant liquidity. The flows come at a time when ETH is still consolidating in a tight range—market watchers are closely considering whether these injections of capital will shift momentum.

Ethereum Price Coiling Before Major Breakout

Over the past two weeks, the Ethereum price has resonated strictly within two horizontal levels of $4,520 to $4,258. The consolidation displayed a series of neutral candles with long rejection on either side, reflecting a lack of initiation from buyers or sellers after a brief correction from the new high of $4,955.

Interestingly, the lateral trend is positioned at the support of a long-coming ascending trend in the daily chart. Since late June 2025, the ETH price has been receiving dynamic support from a rising trendline to recuperate its exhausted bullish momentum. If history repeats, a potential rebound from this support could drive the next recovery leap towards the $5,000 high.

With today’s price jump, the Ethereum price is less than 2% short of challenging the overhead resistance of $4,500. The momentum indicator RSI (relative spread index) has an inclined slope of 65%, indicating a renewed bullish sentiment in the market. A potential breakout would release the price from an uncertain range and drive sustained recovery of over 9.6% to re-challenge the ATH resistance at $4,966.

On the contrary, if the Ethereum price fails to build sufficient bullish momentum for the range-bound breakout, the sellers could re-enter the market and force a bearish dip down below the ascending trendline. The breakdown could accelerate, perish momentum, and drive a prolonged correction time in price.

Also Read: Safety Shot Holds 2.5% of BONK Supply, Worth $55M