ETH, the native cryptocurrency of the smart contract giant Ethereum, jumped 2% during the Thursday U.S. market session. The upswing signals that altcoin is gradually building its momentum following the recent buying pressure that pushed the pioneer cryptocurrency Bitcoin to a new high of $117,000. Along with the broader market momentum, the increasing institutional investment in Ether is steadily supporting the price for higher recovery. The technical chart further reinforces the potential for breakout amid a golden EMA crossover.

Ethereum Price Gains Momentum Amid Institutional Accumulation

Over the past two weeks, the Ethereum price showed a strong recovery from $2,150 to the current trading price of $2,983, registering a 40% growth. The upswing followed the accelerated buying pressure in the broader market, which pushed Bitcoin to a new high of $117,000. Along with the general bullish sentiment, the Ether coin witnessed increasing investment, reinforcing its potential for the next breakout.

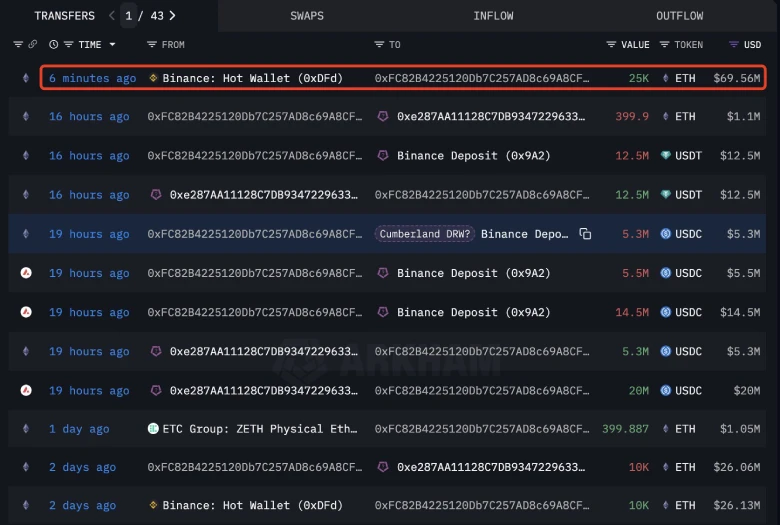

According to blockchain tracker Lookonchain, a crypto wallet, 0xFC82, likely linked to Cumberland, withdrew 25,000 ETH (worth approximately 69.56 million) from Binance Exchange. In the last three days, this wallet has withdrawn a total of 55,383 ETH from Binance, currently worth $148 million.

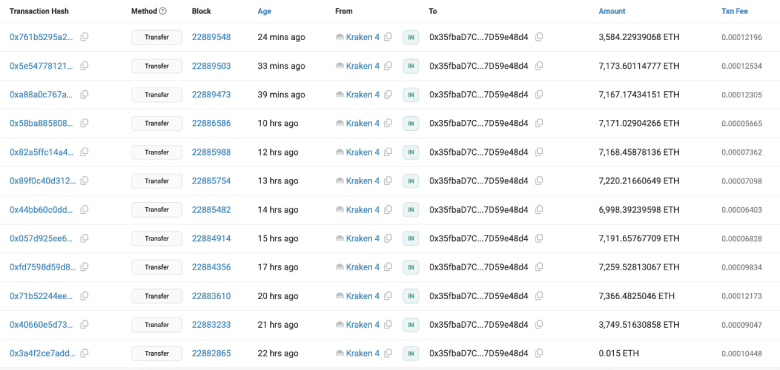

Similarly, a newly created wallet, 0x35fb, has withdrawn 72,050 ETH (worth approximately 199.65 million) from Kraken in the last 24 hours.

Such accumulation from high-net-worth investors and institutions has bolstered long-term growth in assets.

Golden EMA Crossover Hints at Continued Bullish Momentum

Amid the recent market recovery, the Ethereum daily chart shows a bullish crossover between the 50- and-200-day exponential moving averages. Historically, this technical pattern has coincided with strong market rallies and major reversal setups.

A similar crossover in November 2024 triggered a sharp 34% rally, pushing ETH to a local peak of $4,150. Looking further back to November 2023, the same pattern preceded an even more significant 45% surge, reinforcing its reputation as a reliable early indicator of upward price movement.

Adding to the bullish momentum, the rising ETH price also signaled a bullish breakout from the neckline resistance of a traditional reversal pattern known as an inverted head and shoulders.

If the pattern holds true, the coin price could aim for a high of $4,355, registering 51% growth potential. However, this bullish rally could face overhead resistance at $3,437, $3,744, and $4,108.