On Thursday, July 3rd, the Ethereum price recorded an insignificant gain of 0.3% to reach its trading value of $2,580. A long-wick rejection attached to the daily candle accentuates the intense overhead supply that restricts buyers’ breakout potential from the $2,700 barrier. While a temporary pullback seems plausible, institutional investors are showing their confidence in ETH for a potential surge above $3,000.

Ethereum Sees $230M Institutional Buys by Matrixport, Abraxas

In the last two weeks, the Ethereum price bounced from a low of $2,116 to its current trading price of $2,573, projecting a 27.66% surge. This rebound is largely driven by the fading panic selling triggered by geopolitical tensions in the Middle East.

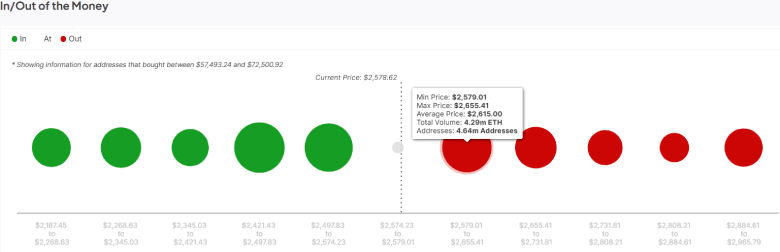

However, the rising pressure faces overhead supply at the $2,600 level, signaling a risk of a short pullback. The on-chain data from Sentora shows a substantial supply volume of over 6 million ETH in the $2,600-$2,700 price range.

That said, after the price surge above $2,700, the sell-side liquidity begins to thin out considerably.

Adding to the bullish note, the institutional activity has intensified over the last 24 hours. According to blockchain data tracker Lookonchain, a wallet possibly linked to Matrixport withdrew 40,734 ETH (valued at approximately $104 million) from the Binance and OKX exchanges.

In a separate transaction, Abraxas Capital also pulled 48,823 ETH (~$126 million) from Binance and OKX exchanges over the past 24 hours.

This institutional interest could bolster the ETH price to surpass the overhead resistance of $2,700 and support a further recovery rally.

ETH Price Nearing a Make-or-Break Point

The daily chart analysis shows the Ethereum price is repeatedly bouncing from two converging trend lines, which offer dynamic support and resistance to traders. The recent ETH recovery also initiated from the aforementioned support trendline, as the price is now trading at $2,575.

The altcoin is poised for an imminent breakout as the price is nearing the apex of the intersecting trendlines.

As institutional accumulation escalates, the ETH price shows a higher possibility of an upside breakout, which could bolster the price to surpass the $2,862 resistance and extend to the $3,000 mark.

On the contrary, a breakdown below the bottom trendline will signal the continuation of the prevailing correction and retest the $2,100 floor support.