ETH, the native cryptocurrency of smart contract giant Ethereum, recorded a low volatility downtick of 0.7% on Thursday, June 19th. This intraday loss signals the continuation of the ongoing correction trend, as investors’ sentiments remain uncertain amid the escalating military action in the Middle East. Despite this sluggish price action, the Ethereum blockchain appears healthier than ever, as a massive number of new users are joining the network every week.

Will this fundamental growth propel the ETH price into a high-momentum reversal?

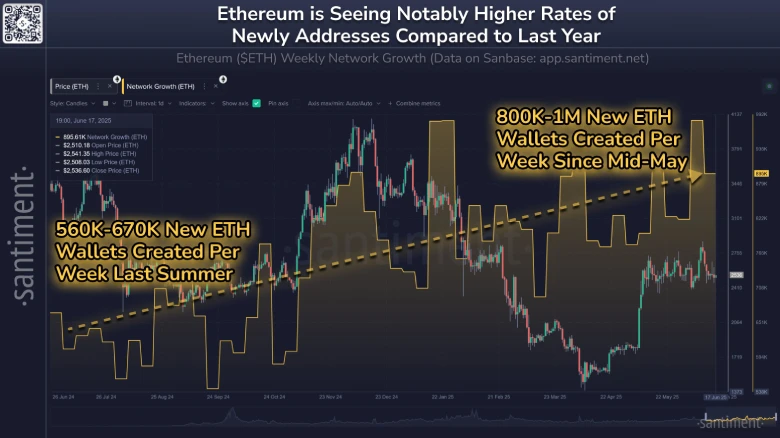

Ethereum Adds 1M Weekly Addresses Amid Middle East Crisis

Over the last 9 days, the Ethereum price has declined from $2,882 to $2,500, representing a 2.9% loss in its current trading value. The escalating military action between Israel and Iran primarily drove the selling momentum, now intensifying amid growing rumors of potential U.S. involvement.

While the correction trend remains intact, the utility and growth on the Ethereum network look healthier than ever. According to on-chain analytics platform Santiment, the number of new ETH addresses generated weekly has surged to 800,000–1 million since mid-May. This number indicates a roughly 38% increase from last year’s 560,000 to 670,000 new Ethereum addresses created per week.

Historically, such spikes in new applications have been associated with bullish network fundamentals, often preceding upper price movements. If the trend sustains, the ETH price will likely experience natural demand pressure and prepare for a bullish rebound.

Key Levels to Watch Amid ETH Price Consolidation

For over a month, the Ethereum price has demonstrated a consolidation trend, resonating within trendlines that have ranged from $2,400 to $2,875. The coin price bounces thrice from each trendline, indicating the lack of initiation from buyers or sellers.

Typically, such consolidations after a significant recovery indicate a temporary pause for buyers to recuperate their bullish momentum and drive the next breakout. However, the inclined nature of these trendlines suggests a potential risk of a breakdown below this support line.

Thus, the potential traders must remain cautious and wait for the price to reveal its intention with a breakout from either trendline.

If the ETH price breaks out from the overhead trend at $2,875, the prevailing recovery trend will continue and target the next significant resistance level of $3,440.

On the contrary, if the coin price breaks below the bottom trendline at $2,470, the service could drive a 14% correction to hit $2,100.

Also Read: Solana to Outperform Ethereum: SkyBridge’s Scaramucci