ETH, the native cryptocurrency of the Ethereum network, plunged over 1% during Thursday’s U.S. market session. The long-tail rejection candle in the daily chart accentuates the intense overhead supply at the $2,500 level, signaling the continuation of the correction trend. Despite a short-term bearish outlook, recent on-chain data indicates a strong staking trend on the Ethereum network, signaling that the overall market sentiment remains bullish.

Oversupply Signals Continued Correction for Ethereum

Earlier this week, the Ethereum price witnessed a notable recovery from $2,115 to $2,521, accounting for a nearly 20% surge. However, the primary reason behind this surge was the potential ceasefire between Israel and Iran as announced by U.S. President Donald Trump.

As the two nations continue to show hostility, the majority of major cryptocurrencies, including Ethereum, witness overhead supply. In the daily chart, the ETH price displays a high-wick rejection candle at the combined resistance of $2,500 and the 50-day exponential moving average, indicating that sellers are actively defending this level.

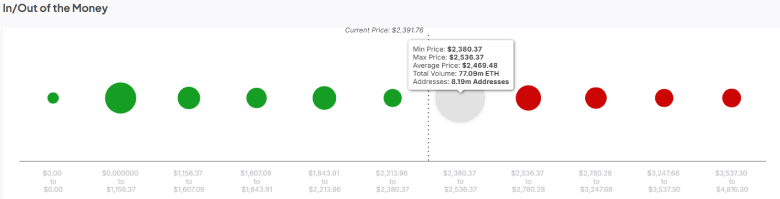

Sentora’s on-chain data further highlights significant supply pressure around the $2,500 level. According to the Global In and Out (GIOM) metric, the price range between $2,380 and $2,536 encompasses 8.9 million addresses, with a volume of 77.09 million ETH. Thus, a potential surge to this level allows traders to sell their holdings at a break-even, resulting in a substantial overhead supply pressure.

If the bearish momentum persists, the ETH price could plunge 12.5% to retest the 50% retracement level at $2,106.

Historically, this retreatment level has served as a major support, allowing buyers to recover the bullish momentum for the next advance.

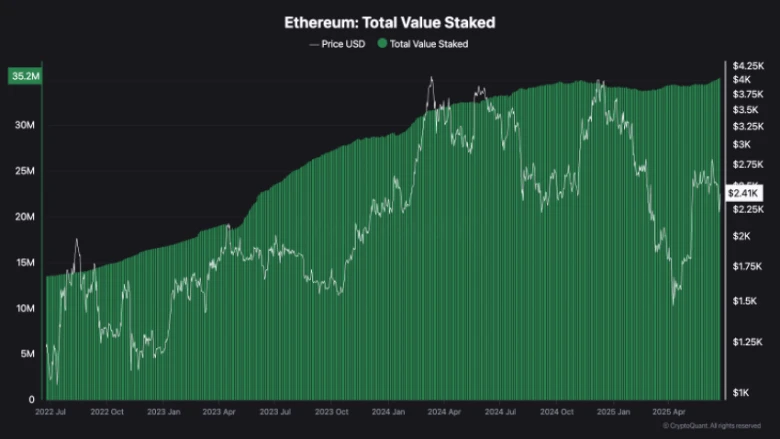

Sentora Data Reveals Strong Staking Activity

In a recent tweet, Sentora highlighted Ethereum’s strong position in the staking sector. With a sustained uptrend, the total volume locked on the network has surpassed 35 million ETH, indicating nearly 30% of the total Ethereum supply being committed to staking.

The substantial amount of ETH being locked showcases investors’ confidence in this asset, despite current market uncertainty. If the trend persists, it could continue to reduce supply availability in the market and drive an upward momentum in price.

Also Read: US Congress Extends Crypto Bill Deadline to September