ETH, the native cryptocurrency of the Ethereum network, plunged over 1.4% during Thursday’s U.S. market session. The slight pullback followed a broader market pullback as China denied any active negotiation with the United States. As the risk of prolonged correction persists, the ETH price could face another breakdown as whales and retails investors hint substantial sell-off

Ethereum Onchain: 305K ETH to Exchanges & 63K ETH Whale Dump

Over the past two weeks, the Ethereum price bounced from a low of $1,385 to its current trading price of $1,766, projecting a 27.8% surge. This bullish surge witnessed significant profit booking from whales and retail investors, signaling a growing sell-side pressure.

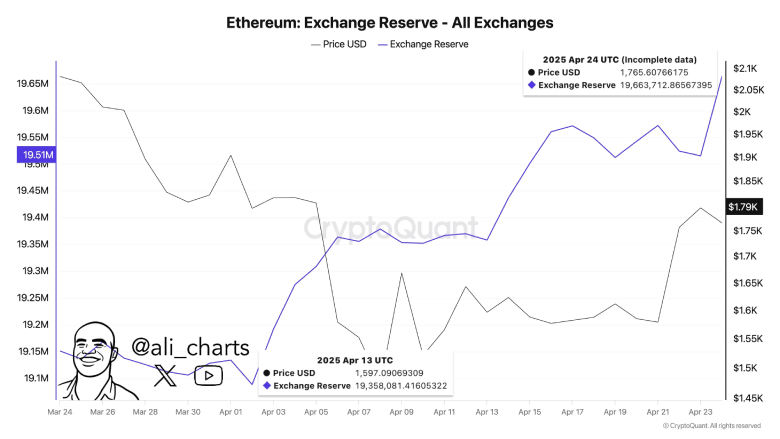

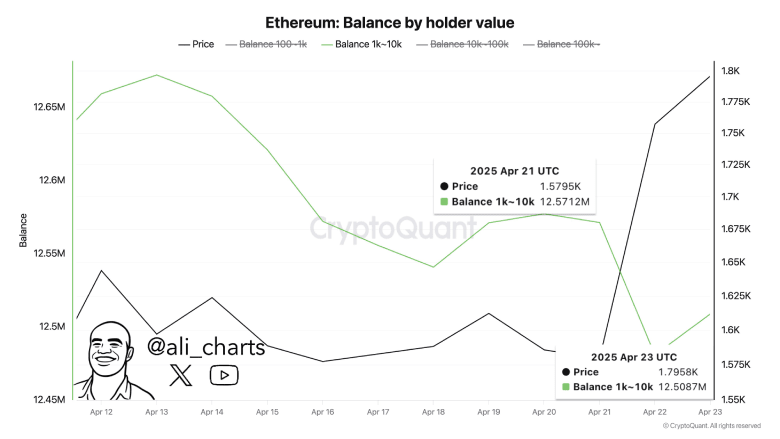

According to data shared by Ali Martinez, more than 305,000 ETH have been transferred to centralized exchanges over the past week.

Simultaneously, the crypto whales have reportedly offloaded over 63,000 ETH in just the past 48 hours.

These two metrics combined—rising exchange reserves and declining whale holdings—often precede short-term corrections, as market supply increases and bullish momentum fades.

ETH Price Stands at Make-or-Break Floor Amid Channel Formation

An analysis of Ethereum’s daily chart shows that the recent reversal bounced from the support trendline of the falling channel pattern. The pattern’s two parallel-walking trendlines theoretically offer dynamic resistance support to the asset before the price gives a major breakout.

With today’s market drop, the ETH price is nearly 13.5% short of the challenging channel resistance around $2,000. If the buyers flip the overhead resistance into potential support, the altcoin will gain sufficient momentum to hit $2,875, followed by $3,400.

On the contrary, the channel pattern resistance stands as a major pivot level for the Ethereum price. The previous reversal from this resistance plunged the asset to 24%-36%, signaling a sell-the-bounce sentiment among investors.

If the market selling persists, the ETH price will likely revert from channel resistance and test another breakdown below $1,400.

Also Read: Will Bitcoin Return to Sub-$90k Level as China Denies Trade Talk Claims?