In early June, the cryptocurrency market experienced a bullish turnaround, with the Bitcoin price holding its ground above the $103,000 floor. The subsided selling pressure in BTC has bolstered the majority of major altcoins, including ETH, to kickstart a relief rally. However, the Ethereum price shows potential to rebuild its momentum amid the formation of a continuation pattern, and only weak resistance blocks its path.

Ethereum Price Consolidation Hints Major Breakout

In the last week of May, the cryptocurrency market experienced a sudden sell-off as Bitcoin quickly reverted from its new high of $112,000. The selling pressure can be attributed to post-rally relief and continued trade tensions between the United States and other countries.

While most major altcoins followed the bearish momentum, the Ethereum price showed notable resilience above the $2,400 floor. This led to a consolidation trend between two trendlines, as shown in the chart below, forming a wedge pattern.

In the 4-hour chart, the coin price shows notable price swings in both directions, indicating no initiation from buyers or sellers. However, these lateral movements typically allow the prevailing trend (bullish in this scenario) to regain momentum and offer the breakout move.

The entire consolidation hovering above the 200-day exponential moving averages accentuates that the broader trend is bullish.

Thus, the ETH price could breach the overhead resistance and aim towards a rally to $3,450, followed by $3,750.

ETH’s Onchain Data Signals Weak Resistance Ahead

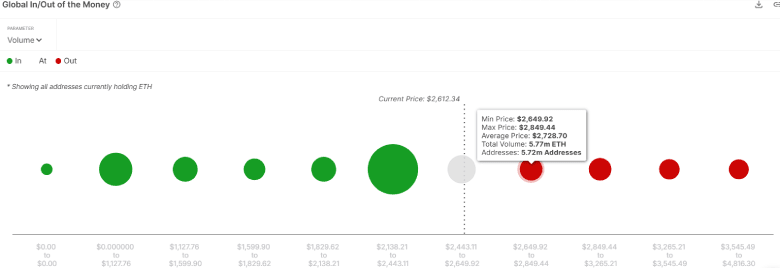

Ethereum’s on-chain data further backs the bullish narrative as the in/out of the money metric highlights weak resistance against buyers. Data from intotheblock analytics shows approximately 5.72 million user addresses are holding 5.77 ETH at an average price of $2,728. Furthermore, the $3,078 average price holds 6.04M ETH by 13.53 addresses.

These Ethereum volumes are shown in relatively small-sized circles (red), indicating that they are less at risk of overhead supply. Therefore, the path of least resistance is upward.

However, if the Ethereum price breaks the lower boundary of the wedge with the 200 EMA, the bullish thesis will get invalidated, and sellers will drive a further correction.

Also Read: Ethereum Eyes $3,000 Recovery as SharpLink Files $1B ETH-Backed Offering