Ethereum, the second-largest cryptocurrency by market capitalization, plunged 1.25% during Wednesday’s U.S. market hours to trade at $2,419. This downtick was likely triggered by substantial selling pressure from early Ethereum investors despite an overall uptick in the broader crypto market. As the Iran-Israel war continues to pressure investor sentiment, the ETH price is likely to revert from the $2,500 mark, driving its next downswing to the $2,000 mark.

Early Ethereum Whale Liquidates Millions

Earlier this week, the crypto market witnessed a bullish turnaround following the announcement of a ceasefire between Israel and Iran by U.S. President Donald Trump. The news spread positive sentiment in the broader market, and Bitcoin bounced to the $108,000 mark.

However, the bullish momentum struggled to sustain as the two nations violated the ceasefire the very next day. In addition, Trump also warned that the conflict between Israel and Iran could restart “perhaps soon,” as both nations continue to show hostilities, Reuters reported.

Thus, the BTC price displayed overhead selling with a long wick rejection candle, while the ETH price dropped 1.6% on Wednesday.

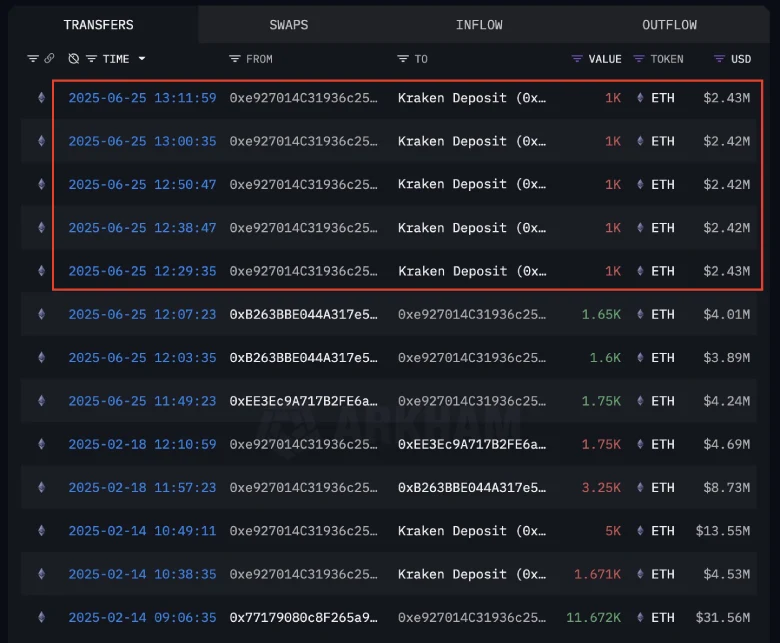

The additional selling pressure on ETH can be linked to the Ethereum ICO players offloading their assets amid market uncertainty. According to blockchain tracker SpotOnChain, an early Ethereum investor deposited 5,000 ETH (approximately $12.1 million) at an average price of $2,424 to the Kraken exchange.

This whale originally received 107,000 ETH during the 2016 ICO at an average cost of $13 and had previously loaded 6,671 ETH (~$18M) on February 14.

Typically, a liquidation or exit of long-term investors has a negative impact on the asset price, fueling speculation about a prolonged downturn.

ETH to Enter Sell-The-Bounce Sentiment

The Ethereum chart analysis shows its recent recovery trend encountered selling pressure at the confluence of 50-and-200 exponential moving averages. As the Middle East crisis continues to pressure the broader market, the ETH price could revert from the $2,500 mark and fall back to the $2,100 support level.

The downswing would create a new lower high formation in the daily chart, signaling an initial shift in market sentiment and growing ‘sell-the-bounce’ mentality among traders.

A bearish breakdown below the $2,100 support would also breach the 50% Fibonacci retracement level for the asset, reinforcing the bearish momentum. The post-breakdown fall could push the price to the $1,950 mark, followed by $1,700.

On the contrary, if the PTH buyers manage to reclaim the 50 and 20 EMS probes, the buyers could regain their confidence and rechallenge the $2,863 swing high.