- The Ethereum price poised for another 5.5% droop as consolidation trend extended after key breakout failure.

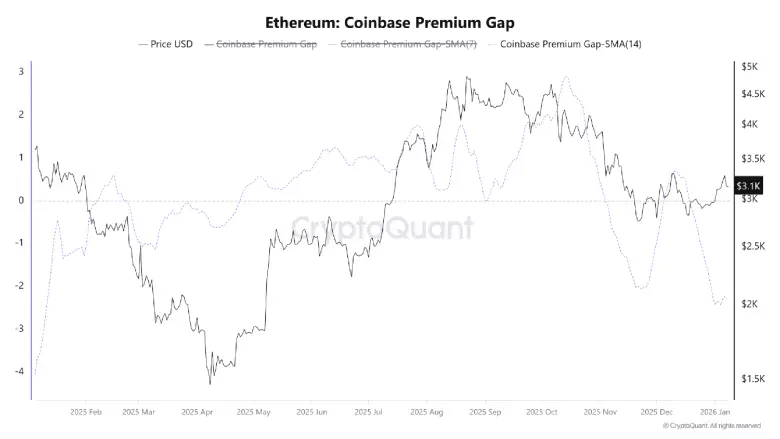

- Ethereum’s Coinbase Premium Gap slipped to levels last seen in February 2025, reflecting reduced US-based buying activity.

- In contrast to lower high formation in price, the RSI indicators show higher slope in the daily chart, accentuating a failure from buyers to sustain higher value despite strong momentum.

On Thursday, January 8th, the Ethereum price dipped over 2% to reach $3,099 trading value. This price pullback is gradually eroding the gains that ETH’s acquired during the first seven days of 2026, as the crypto market witnessed renewed selling pressure. A risk of prolonged correction in ETH price raises as on-chain analyst highlights a multi-month low reading in Ethereum’s Coinbase premium gap, signaling weak US institutional demand.

ETH Coinbase Premium Gap Slides to -2.3 as US Buying Pressure Fades

According to a recent analysis from CryptoOnchain, Ethereum’s Coinbase Premium gap metric records another dip in January 2026, falling to a level last recorded in February 2025, signaling a significant decline in buying activity from US-based participants.

In recent times, on-chain data from CryptoQuant reveals that the 14-day simple moving average of the Coinbase Premium Gap has dropped to around -2.3, which is the lowest level ever recorded since February 2025. This indicator measures the difference in price between Ethereum on Coinbase, which is often a measure of institutional and U.S. spot market interest and Binance, which is a measure of more global retail trading patterns.

Typically, the negative reading indicates that the ETH price is trading at a discount on Coinbase than to Binance, signaling a lack of buying interest from US-based institutional investors.

With today’s downtick, the Ethereum price reverted to $3,111. The journey of the asset since the peak of October 2025, around $4,700, has been consolidation and corrections with the latest premium weakness joining other observations of lack of institutional support in the USA.

Historically, a trend of positive premiums where prices on Coinbase traded higher than Binance has often bolstered sustainable price recovery. The continuous downward trend has led to closer examination of whether the demand dynamics will turn around or continue to pressure the performance in the short term.

Ethereum Price to Extend Current Consolidation As Buyers Failed on Key Breakout

In the last 48 hours, the Ethereum price has dropped from $3,295 to $3,115, accounting for a 5.45% loss. The downtick followed broader market pullback as the majority of them witnessed a renewed supply pressure after strong recovery last week.

However, a deeper analysis into ETH’s daily chart shows that the coin price witnessed a failed breakout from the resistance trendline of symmetrical triangle pattern. Since early November, the coin price has been resonating between its two converging trendlines, creating a short consolidation trend.

As the ETH buyers failed to breach its upper boundary, the coin price is heading back to the bottom trendline at $2,930 with accelerated momentum. The relative strength index (RSI) indicator down to 54% accentuates a neutral market sentiment that could bolster further correction in price.

With sustained selling, ETH could plunge 5.8% and challenge the pattern’s support trendline at $2,930. A bearish breakdown below this floor would strengthen the seller’s grip over this asset, to drive further correction in price.

On the contrary note, if the bulls still manage to hold the bottom support trendline, the Ethereum price could prolong its consolidation trend and reattempt for upside breakout.