- Ethereum price rides a short-term correction trend within the formation of a flag pattern.

- On Friday, the crypto market witnessed its largest liquidation event in crypto history as over 1,618,240 were kicked out and total liquidation value reached $19.13 Billion

- ETH’s fear and greed drooped to 19% reflect a uncertain and bearish sentiment among market participants..

On October 10th, the crypto market witnessed a massive sell-off, casting doubt on the much-anticipated “Uptober” rally. Today, the pioneer cryptocurrency, Bitcoin, fell over 10% to hit the $110,000 mark, while the Ethereum price fell over 12% to hit $3,775, leading to a large-scale liquidation of over $19.13 billion. The selling pressure initiated with the renewed trade tension between the U.S. and China and led to cascading liquidations among the majority of major digital assets. Will this downtrend prolong, or ETH coin hold an opportunity to counterattack?

Ethereum Price Suffers Sharp 12% Drop Amid Market-Wide Liquidations

ETH, the native cryptocurrency of Ethereum recorded a sharp sell-off of over 12.2% during Friday’s U.S. market hours to reach $3,775. Consequently, Ethereum’s market cap plunged to $460.52 billion.

The steep decline was preceded by re-emerging geopolitical strains between the U.S. and China after President Donald Trump declared omnibus 100 percent tariffs on Chinese imports and a new ban on exporting crucial software.

The announcement came as a reaction to a statement made by China to its international trade partners about its intentions to impose blanket export restrictions on almost all outbound goods as of November 1. The concurrent policy changes caused a ripple of risk aversion, which applied much pressure to both conventional and digital assets.

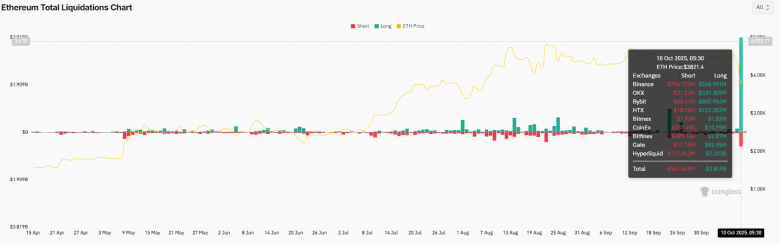

With volatility shooting up, forced liquidations have roiled crypto derivatives platforms. Coinglass data showed that some $3.81 billion of Ethereum in long positions and $561 million of Ethereum in short positions were liquidated in the last 24 hours.

The open interest in Ethereum futures decreased by 28% to $42.2 billion, and funding rates became negative at -0.00497, indicating a bearish mood and active liquidation of leveraged positions on the exchanges.

Ethereum Price Holds at Make-or-Break Support

Since last week, the Ethereum price has witnessed a V-top reversal from $4,738 to the current trading price of $3,785, accounting for a 20% fall. This decline has pushed the ETH price against the bottom trendline of a traditional continuation pattern called a bull flag.

Since late August 2025, the coin price has been actively resonating within the two downsloping trendlines of the pattern, creating dynamic resistance and support. Despite the massive sell-off today, the Ethereum price shows resilience above the combined support of the bottom trendline and the 200-day exponential moving average.

The past performance of the ETH price within the bull flag shows that a retest of the bottom trendline has often recouped the exhausted bullish momentum for the next leap. If the price continues to defend the flag support at $3,700, the coin could drive a potential 24% surge to challenge the overhead resistance at $4,600.

On the contrary, if sellers force a breakdown below the support trendline with a daily candle closing, the selling pressure could accelerate the drive an extended correction to $3,350.

Also Read: European Commission Defends Current Stablecoin Rules ECB Raises Concerns