ETH, the native cryptocurrency of the smart contract giant Ethereum, continued to extend its bullish trajectory on Monday, July 21st, and is currently trading at $3,818. The high-momentum rally, fueled by regulatory developments in the United States, is now poised to challenge a major resistance level for the next breakout. Is the rally to $4,000 close and a bearish correction looming for this asset?

Over 90% of ETH Addresses in Profit

Since last week, the Ethereum price has rallied from a low of $2,927 to its current trading price of $3,781, projecting a nearly 30% gain. The primary catalyst behind this surge was regulatory development in the United States, as the House of Representatives passed all three crypto bills, including the Genius Act, the Digital Asset Market Clarity Act, and the Anti-CBDC Surveillance State Act.

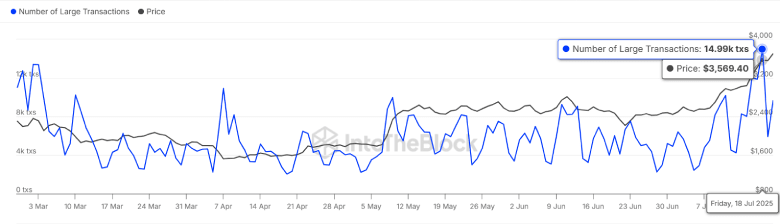

Along with price, the number of large transactions started to increase, reaching a 5-month high of 14.99 transactions.

According to Sentora data, the current recovery has pushed over 90% of Ethereum (ETH) holders into profit, marking the highest percentage since December 2024. As most market participants have acquired their ETH at a price below the current one, the potential upswing ahead would face less friction.

However, the recent on-chain data highlights a key resistance zone at $3,878, which holds around 548.88k Ether among 2.39 million addresses. Thus, a price surge to this level could allow these traders to sell at a break-even point, thereby increasing market supply pressure.

ETH Price Poised to Challenge Multi-Year Resistance

At press time, the Ethereum price is trading at $3,783 with an intraday gain of 0.66%. With today’s upswing, altcoin is just 4.2% short of challenging the resistance trendline of a symmetrical triangle pattern.

Since December 2021, the price has been confined within the two converging trendlines, resulting in a steady sideways trend. Thus, the potential stands as a major pivot level for ETH holders to witness a fresh breakout or renewed correction trendline.

Considering the recent price surge, the momentum indicator RSI has reached the overbought region at 87%, signalling that a correction is needed to stabilize the asset. . If true, the coin price would enter a short correction before hitting $4,000 and test the till $3,700 or $3,440 support to recuperate the bullish momentum.

That said, a bullish breakout from the triangle pattern will likely accelerate buying pressure in ETH, potentially rechallenging the all-time high of $4,842.