ENA, the cryptocurrency of the synthetic dollar protocol Ethena, records a 2.38% jump during Wednesday’s U.S. market hours. This intraday gain counters the broader market pullback as the U.S. Federal Reserve leaves interest rates unchanged at 4.25% – 4.50%. The Ethena price could soon hold a stable support as multiple factors, including whale accumulation, total volume locked (TVL), and a bullish chart setup, bolster its reversal potential.

Ethena Price Rebounds Amid Whale Accumulation & TVL Surge

Over the past 3 weeks, the Ethena price showed a sustained recovery from $0.248 to a recent high of $0.7, registering a 182.4% growth. While the primary catalyst behind this surge was the regulatory development in the United States, the ENA price gained additional momentum amid the increasing whale accumulation and TVL growth.

According to a recent tweet from market analyst Ali Martinez, the crypto whales have accumulated over 79.25 million ENA in the past week. Notably, this accumulation continued unabated despite a three-day price pullback, signaling strong confidence from high-net-worth investors in the asset’s long-term projection.

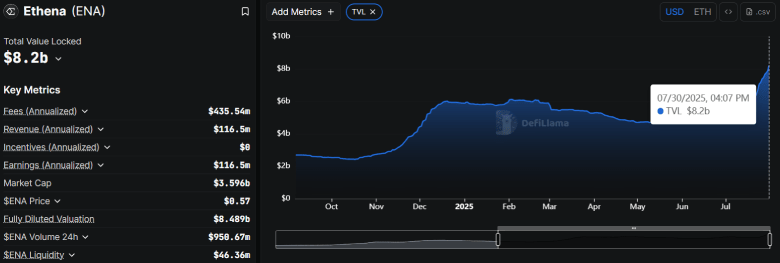

In addition, ENA’s total volume locked (TVL) has bounced from $5.48 billion to the current value of $8.2 billion, registering a nearly 50% growth. This significant uptick implies a strong resurgence in user activity and capital inflows into the Ethena ecosystem.

If the trend persists in these metrics, the coin price could witness a natural demand pressure in the market and an increased potential for a bullish reversal.

ENA Poised For Breakout Amid Cup And Handle Pattern

In the last three days, the ENA price witnessed a bearish pullback from the $0.7 high to a recent low of $0.533, accounting for a 23.86% loss. This correction likely came as a post-rally pullback but revealed the potential formation of a traditional reversal pattern called Cup-and-Handle.

The chart setup is commonly spotted in major market bottoms, as it displays a long accumulation trend in its ‘cup,’ followed by a short pullback to recuperate the exhausted bullish momentum in its ‘handle.

With today’s price jump, the coin price shows a bullish reversal above the 38.2% Fibonacci retracement level at $0.52. The aforementioned support and 50% FIB level at $0.47 could offer buyers stable support for reversal.

Currently trading at $0.593, the altcoin is 18% away from challenging the neckline resistance of $0.7. A potential breakout from this barrier will signal a change in market direction and bolster a potential rally towards $1.158.

On the contrary, if sellers continue to defend the neckline resistance, the ENA price could shift to a short-term sideways trend.

Also Read: Bitcoin Net Realized Profit Plunges From $3.2B—Is More Selling Ahead?