As anticipation is building on the potential approval of XRP exchange-traded funds (ETFs), the community is becoming increasingly optimistic about the cryptocurrency’s bullish rally. In the latest development, the XRP ETF odds have surged to an exciting 99%, sparking speculations about the Securities and Exchange Commission’s imminent approval of about six Ripple-based funds in October.

This development has ignited a fresh wave of enthusiasm within the Ripple community as investors and analysts wonder if the token will soar to new heights. In the wake of this potential game-changer, experts forecast XRP’s future bullish trends, with the targets ranging from $3.6 to an ambitious $30. Now, the question on every mind is- Will XRP ETF approval unlock a new era of growth and adoption, or will it fall short of expectations?

XRP ETF Odds Surge to 99%

According to Polymarket data, the Ripple ETF odds have seen a notable increase today. With experts like Eleanor Terrett shedding light on the possible launch of more than six XRP ETFs in October, traders and analysts are closely monitoring the cryptocurrency’s price movements in response to this development.

Further bolstering these expert insights, the Polymarket data unveils a massive surge in the Ripple ETF approval chances. As per the data, the odds of an XRP ETF approval in 2025 have skyrocketed to an interesting 99%, up by 28%, highlighting the highest possibility of the product launch. In an X post, analyst Amonyx drew the community’s attention to these increasing odds, sparking widespread enthusiasm.

Reportedly, six filings to list exchange-traded funds backing Ripple’s token are pending this week. Reportedly, these filings are submitted by investment giants like Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and Franklin Templeton.

Recently, Bloomberg ETF analysts James Seyffart and Eric Balchunas predicted a 95% chance of approval for the Ripple fund. They based their projection mainly on the official resolution of the Ripple vs SEC lawsuit and the regulatory clarity surrounding the token. This regulatory breakthrough has paved the way for institutional investment and adoption. Also, the recent launch of the REX-Osprey XRPR has further boosted this optimistic sentiment.

How Will This Development Impact XRP Price?

Significantly, the potential implications of the ETF approval this week are far-reaching. The increasing possibility has sparked a flurry of discussions, analyses, and predictions. While analysts claim that the XRP price will make phenomenal changes soon, investors are eagerly waiting to see the outcome.

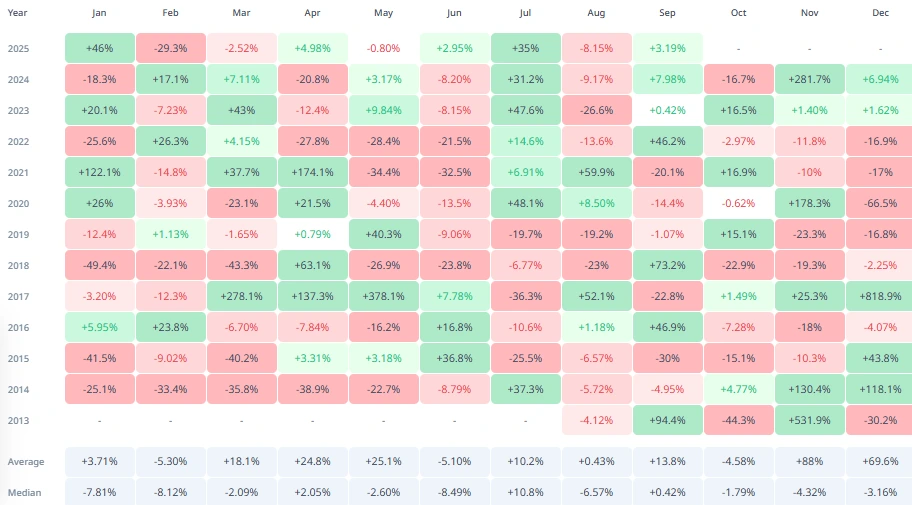

Historically, XRP has a remarkable track record in the fourth quarter, consistently outperforming other periods and delivering impressive gains. Generally, October, November, and December are known for their favorable conditions, often known as Uptober, Moonvember, and Pumpcember. This makes Q4 a seasonally positive window, amplifying ETF-driven gains.

Since 2013, XRP has posted positive returns in Q4, with average gains exceeding 150$ during bull market cycles. Notably, 2017 saw an extraordinary 1.069% surge, as XRP’s price skyrocketed from $0.20 to $2.30 by December, driven by growing cross-border payments and the crypto frenzy. More recent years have also seen significant Q4 gains, with XRP rallying 240% in Q4 2024 and 20% in 2023. This historical trend suggests that this year could also see a similar positive trend in the coming quarter.

Driven by the prevailing optimism, analysts like Gordon have shared their positive thoughts on the second-largest altcoin’s future. According to Gordon, XRP could hit $3.6 in October. On a long-term view, the Ripple token is slated to exhibit a more ambitious rally, with the price targeting massive highs like $20 and even $30. Analyst Zach Rector noted that if XRP continues its positive momentum, it could reach $20-$30 in 2026.