On Monday, June 2nd, the crypto market witnessed a bearish outlook as Bitcoin’s price extended its correction below $110,000. While the majority of major altcoins followed this trend, the dogwifhat price showed a bullish turnaround with a traditional reversal pattern setting its rally toward $2.5. Is the WIF price ready for this jump, or could the broader market force a prolonged correction?

According to CoinGecko, the WIF price trades at $1.17, with a market cap of $953.2 million and a 24-hour trading volume of $379.2 M.

Bear Trap Sets dogwifhat for Bullish recovery

Over the last two weeks, the cryptocurrency market experienced a bearish reversal as Bitcoin’s price failed to maintain its previous all-time high resistance of $109,356. The altcoin market quickly followed this bearish momentum, and dogwifhat (WIF) was no exception.

The WIF price plummeted from $1.39 to $0.786, resulting in a 43.5% loss. This downstream offered a major breakdown below the $0.92 support and exponential moving averages 20, 50, 100, and 200, signaling a bearish outlook ahead.

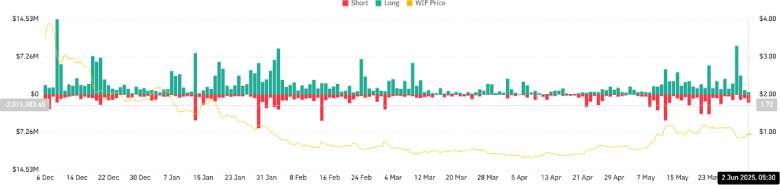

However, with today’s intraday surge of 10%, the dogwifhat reclaimed the $0.92 and 100-and-200-day EMA slope. This failed breakdown resulted in a short liquidation of $1.53 million and a long liquidation of 485.3K at the $2.09 support level, according to CoinGlass data.

If the reversal builds up, the WIF price could rally 43% before challenging the multi-month resistance of $1.39.

Cup and Handle Pattern Hints Bottom Formation

Dogwifhat analysis of the daily chart shows the anticipated upswing in price could delay the formation of a cup and handle. This chart setup is characterized by a long accumulation trend and temporary pullback to regain bullish momentum.

Over the past four months, the WIF price has developed this chart setup, signaling the end of a correction setup. A potential breakout from $1.39 signals a change in market dynamics.

The post-breakout rally could propel this dog-themed memecoin to $2, followed by $2.50.

On the contrary, the current sideways trend will prolong if sellers continue to defend the neckline resistance.

Also Read: Here’s Why Bitcoin Rebound Is Sooner than Expected