- The cryptocurrency market experienced a significant loss as 1.32 billion Dogecoin tokens were released by whales, which led to a 4% price decrease.

- The available trading volume reduced by 26 percent during the previous day and reached a total of 1.99 billion dollars.

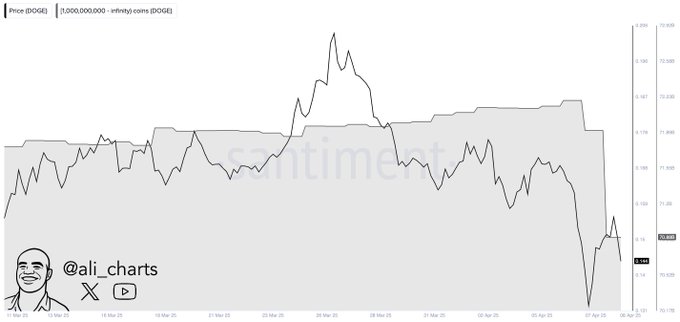

- Price volatility increased when Dogecoin exchanged between 0.1367 dollars and 0.1567 dollars.

Dogecoin (DOGE) faced fresh selling pressure as whales dumped 1.32 billion tokens, sending shockwaves across the crypto market. The quick whale token sell-off caused the DOGE price to drop 4% as the token broke through valuable support marks.

The dump reveals general market doubt, but Dogecoin maintains its support levels established since October 2023.

The market recorded a major 26% decrease in trading volume during this period, resulting in a last 24-hour total of $1.99 billion. The DOGE price remained volatile during its trading interval, from $0.1367 to $0.1567. The market experienced price stability while large-scale investors generated downward pressure on trading platforms, thus increasing negative momentum across the boards.

Santiment data confirmed whale activity as the key factor behind the recent volatility in Dogecoin’s price performance. Major whale-selling operations weakened market sentiment while creating a negative short-term market outlook. Risk-on sentiment has decreased, while preceding market weaknesses tend to emerge following this type of indicator.

DOGE Price Faces Critical Support Test

Analyst Ali Martinez noted that $0.13 represents a major support level, which corresponds to the 61.8% Fibonacci retracement zone. The price has functioned as robust support since October 2023, as it sustains the upward trend with a notable rising trendline.

The ascending line of DOGE is an important model for forecasting market direction for the next few periods. When DOGE stabilizes above $0.13 and reaches buying control, bearish sentiment will break down.

A price drop below the $0.13 support point would decrease purchasing strength, which might prompt additional market sales. According to technical indicators, the market displays an equivocal condition because declining sentiments require matching buying activity before preventing additional price declines.

DOGE market capitalization stayed at approximately $0.1467 recently, and its price behavior suggests more market deterioration. According to the current DOGE prediction, the token hovering near this crucial level for an extended period increases the likelihood of a breakout in either direction.

DOGE Futures Data Signals Bearish Turn

The data from CoinGlass derivatives showed that futures open interest dropped by 1.12%, which indicated that trader optimism began to fade.

The slight modification gives greater credibility to bearish retracement predictions that will develop as negative pressure rises. The indicators demonstrate that weakened fundamentals produce a potentially significant market downturn during the following months.

Market conditions favor bears, so Ali Martinez believes DOGE could reach a minimum value of $0.06. Such a price drop would eliminate 59 percent of DOGE’s value from its current market level while making $0.13 an essential pivot point. Such a drop would occur when bears sustain their activity while preventing support zone reclamation.

The market outlook will likely adopt defensive strategies when DOGE loses its established support levels.

The bearish market predictions expand their dominance because market participants decrease their trading volume and dispose of their long positions. Dogecoin’s price could face steeper losses in the coming weeks without a catalyst to reverse momentum.