DOGE, the largest meme cryptocurrency by market cap, has plunged over 11% during Wednesday’s U.S. market hours to trade at $0.243. This correction aligns with a broader market pullback amid profit-booking sentiment among investors. While the sharp reversal may create panic among retail investors, the crypto investors continue to accumulate Dogecoin in anticipation of a long-term uptrend.

Crypto Whales Accumulate 310 Million DOGE Amid Price Pullback

In the last three days, the Dogecoin price showed a bearish downturn from $0.287 to $2.40 current trading value of $2.40, registering a 16.3% loss. The pullback came as a profit booking from short-term investors as the digital assets witnessed a major rally in the last three weeks.

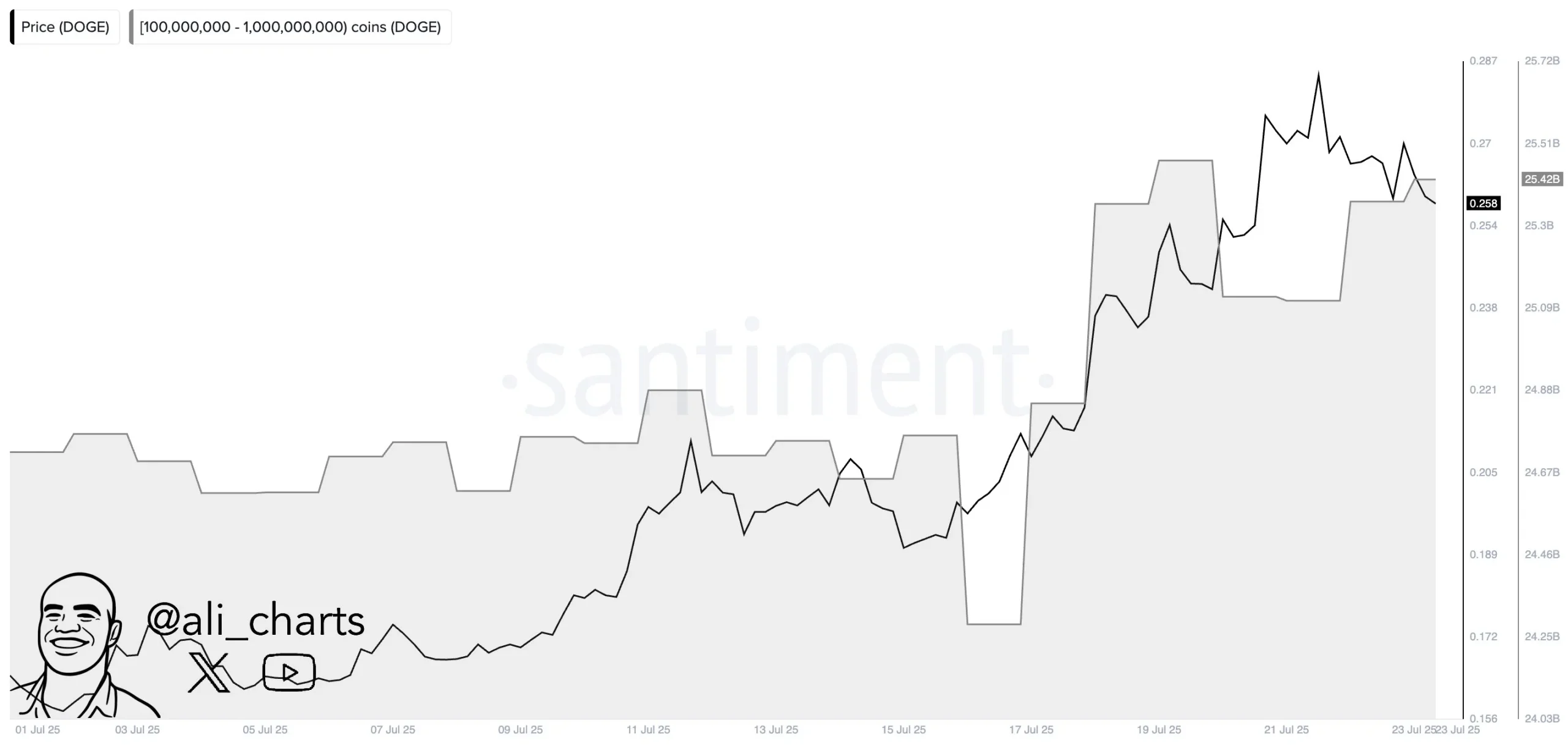

While the short pullback may discourage retail investors, high-net-worth investors leveraged this pullback to accumulate more Dogecoin. In a recent tweet, market analyst Ali Martinez has highlighted a major purchase of over 310 million Dogecoins from crypto whales in the last 48 hours, signaling a major accumulation trend.

Historically, buying activity from crypto whales has often aligned with major market rallies and subsequent reversals in their respective assets.

DOGE Price Holds Major Support of Triangle Pattern

Over the past week, the Dogecoin price showed high momentum from $0.188 to a recent high of $0.287, registering a 52% growth. This rally gave a decisive breakout from the upper boundary of a triangle pattern in the daily chart. Typically, the two converging trendlines of the pattern signal a temporary halt in a price trend to recuperate prevailing momentum.

The recent market pullback currently retests the breached trendline as a potential support before initiating the next leg up. A potential golden crossover between the 50- and 100-day exponential moving average could reinforce the bullish sentiment for a post-breakout rally.

If the support holds, the DOGE price could bounce over 6% to reach its target of $0.39.

Alternatively, if the retest candle re-enters the triangle range, the sellers could strengthen their grip over this asset for a prolonged correction.

Also Read: South Korea Pushes Back on Crypto ETF Risk Amid Market Concerns